Risk management

Eni has developed and adopted a model for Integrated Risk Management (IRM) that targets to achieve an organic and comprehensive view of the Company main risks1 , greater consistency among internally-developed methodologies and tools to manage risks and a strengthening of the organization awareness, at any level, that suitable risk evaluation and mitigation may influence the delivery of Corporate targets and value.

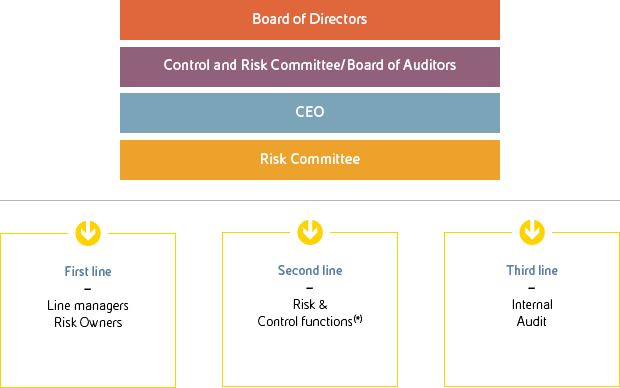

Integrated Risk Management Model

The IRM has been defined and updated consistently with international principles and best practices. It is an integral part of the Internal Control and Risk Management System (see page 31) and is structured on three control levels.

The first level is represented by risk owners, whose responsibility lies in risk assumption and related treatment measures.

The second level concerns the risk control functions that cooperate in drafting the methodologies and risk management tools and perform control activities through structures that are independent from operating management.

The third level is represented by the independent assurance provider that provides independent certifications on the planning and functioning of risk management processes.

(1) Potential events that can affect Eni’s activities and whose occurrence could hamper the achievement of the main corporate objectives.

(*) Including Integrated Risk Management function.