integrated report

Scroll down for more content

Materiality and stakeholder engagement

Eni’s materiality definition process

Materiality is the result of the identification and priorization of the relevant sustainability issues that impact significantly the company’s ability to create value.

Eni’s materiality definition process aims to ensure that the relevant issues are both shared with the highest decision levels and also taken into account in all the company processes starting from the integrated risk management process, strategy planning, stakeholder engagement, reporting and internal/external communication, to the implementation of operational decisions.

The first step of the materiality definition process is the identification of relevant issues implemented on the base of the top management’s strategic vision, the results of the risk assessment and the stakeholders’ perspective.

In 2015, the vision of top management has arisen in the phase of the definition of four-year strategic plan: in the guidelines defined by the Chief Executive Officer, preceding the definition of the four-year plan, were highlighted the most important sustainability issues for the business.

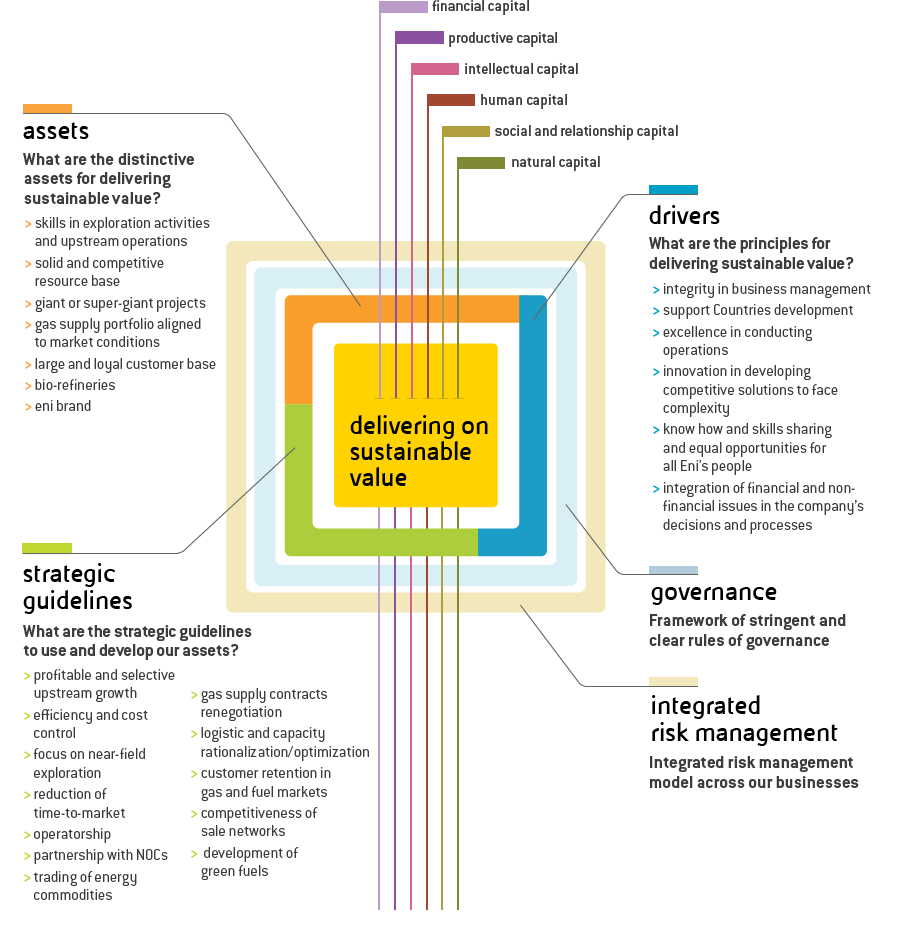

Business model

Eni’s business model targets long-term value creation for its stakeholders by delivering on profitability and growth, efficiency and operational excellence and handling operational risks of its businesses, as well as environmental conservation, and local communities relationships, preserving health and safety of people working in Eni and with Eni, in respect of human rights, ethics and transparency.

The main capitals used by Eni (financial capital, productive capital, intellectual capital, natural capital, human capital, social and relationship capital) are classified in accordance with the criteria included in the “International IR Framework” published by the International Integrated Reporting Council (IIRC). Robust 2015 financial results and sustainability performance, notwithstanding a weak scenario for commodities prices, rely on the responsible and efficient use of our capitals.

Hereunder is articulated the map of the main capitals exploited by Eni and actions positively effecting on their quality and availability.

At the same time, the scheme evidences how the efficient use of capitals and related connections create value for the company and its stakeholders.

For detailed information on results associated to each capital and to the way by which each strategic target is achieved see this Integrated Annual Report and the Integrated Performance tables.

Targets and performance drivers

The table below shows how actions taken in managing each main capital, contribute to achieve business targets.

The different actions are classified on the basis of four strategic targets which lead Eni’s business segments.

The actions reported below represent the management system of each capital which allow to achieve business goals, on the one hand reducing risks, on the other, increasing profitability.

Cash flow and value generation

2016-2019 targets

- Fuel value and increase explorative resources

- Growth in upstream cash generation

- Profitability and sustainable cash generation in the Gas & Power segment

- Ebit adjusted and free cash flow steadily positive in the R&M segment

- Focus on efficiency

Strategy execution

Competitive environment

A challenging market

An international environment characterized by oversupply and low prices, the ongoing transformations in the European mid-downstream businesses and the gradual process of decarbonisation in the energy system, represent the main challenges faced by the oil companies.

The surplus in supply and the downward dynamic on prices require a strategy of capex rationalization, addressed to projects with lower break-even and initiatives finalized to cost reduction.

To achieve the target of limiting global temperature increase, natural gas can play a central role as main carbon alternative.

Risk management

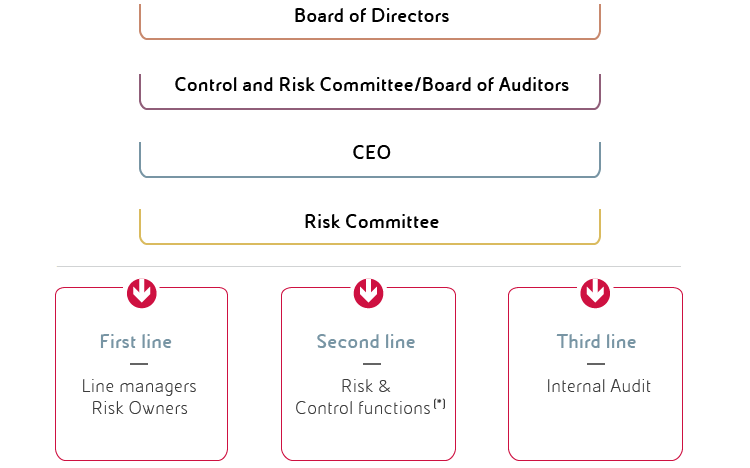

Eni has developed and adopted a model for Integrated Risk Management (IRM) that targets to achieve an organic and comprehensive view of the Company’s main risks1, greater consistency among internally-developed methodologies and tools to manage risks and a strengthening of the organization awareness, at any level, that suitable risk evaluation and mitigation may influence the delivery of Corporate targets and value.

Integrated Risk Management Model

The IRM Model has been defined and updated consistently with international principles and best practices. It is an integral part of the Internal Control and Risk Management System (see page 31) and is structured on three control levels.

The first level is represented by risk owners, whose responsibility lies in risk assumption and related treatment measures.

The second level concerns the risk control functions that cooperate in drafting the methodologies and risk management tools and perform control activities through structures that are independent from operating management.

The third level is represented by the independent assurance provider that provides independent certifications on the planning and functioning of risk management processes.

(1) Potential events that can affect Eni’s activities and whose occurrence could hamper the achievement of the main corporate objectives

(*) Including Integrated Risk Management function.

Governance

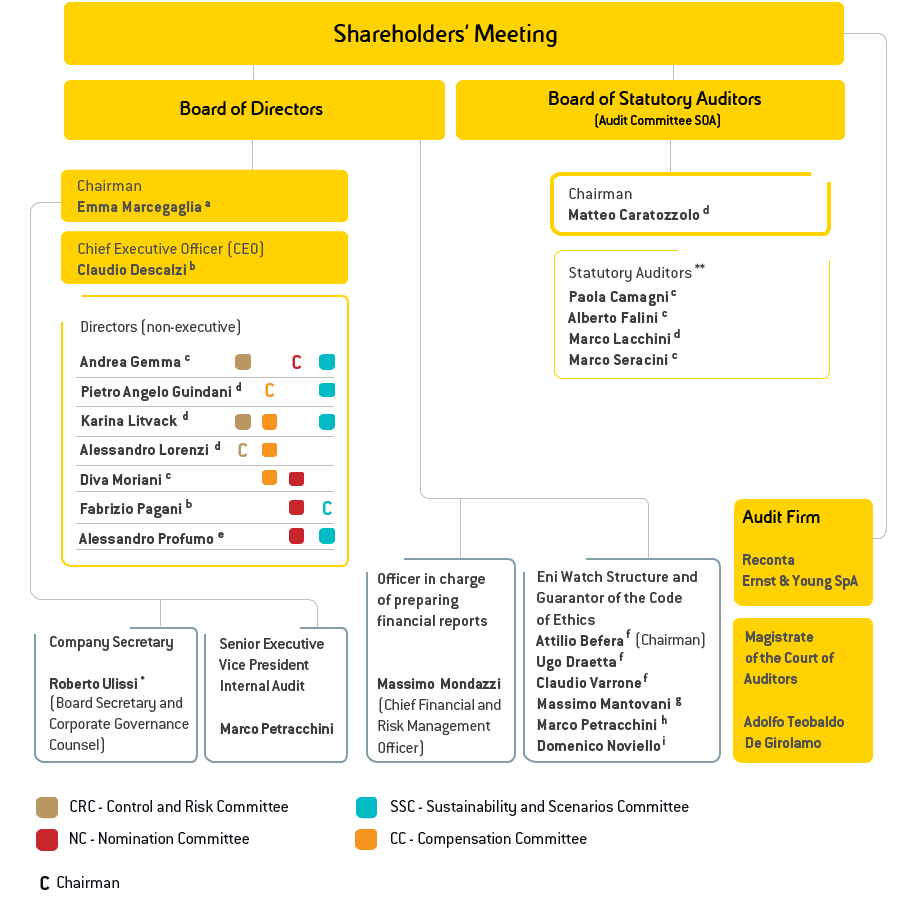

The Eni Corporate Governance structure

Eni’s Corporate Governance structure is based on the traditional Italian model, which – without prejudice to the role of the Shareholders’ Meeting – assigns the management of the Company to the Board of Directors, supervisory functions to the Board of Statutory Auditors and statutory auditing to the Audit Firm.

Eni’s Board of Directors and Board of Statutory Auditors, and their respective Chairmen, are elected by the Shareholders’ Meeting using a slate voting mechanism. Three directors and two statutory auditors, including the Chairman of the Board of Statutory Auditors, are elected by non-controlling shareholders, thereby giving minority shareholders a larger number of representatives than that provided for under law. The number of independent directors provided for in the Eni By-laws is also greater than the number required by law.

The following chart summarises the Company's corporate governance structure at December 31, 2015:

a – Member appointed from the majority list, non-executive and independent pursuant to law.

b – Member appointed from the majority list.

c – Member appointed from the majority list and independent pursuant to law and Corporate Governance Code.

d – Member appointed from the minority list and independent pursuant to law and Corporate Governance Code.

e – Member appointed by the Board of Directors on July 29, 2015 – in replacement of Luigi Zingales, who resigned from the Board on July 2, 2015

– independent pursuant to law and Corporate Governance Code.

f – External member.

g – Chief Legal & Regulatory Affairs.

h – Senior Executive Vice President Internal Audit.

i – Executive Vice President Labour Law and Dispute.

* Also Senior Executive Vice President Corporate Affairs and Governance.

** The following are Alternate Auditors:

Stefania Bettoni – Member appointed from the majority list and independent pursuant to law and Corporate Governance Code.

Mauro Lonardo – Member appointed from the minority list and independent pursuant to law and Corporate Governance Code.