Performance of the year

In 2013 the positive trend in employees and contractors injury frequency rates was confirmed, with a reduction of 28.9% and 50.1%, respectively.

In 2013, adjusted net loss was €246 million, decreasing by €719 million from 2012 reflecting worsening competitive environment determining a fall of sale prices and margins in Italy, the effects of which were exacerbated by minimum off-take obligations provided by long-term supply contracts.

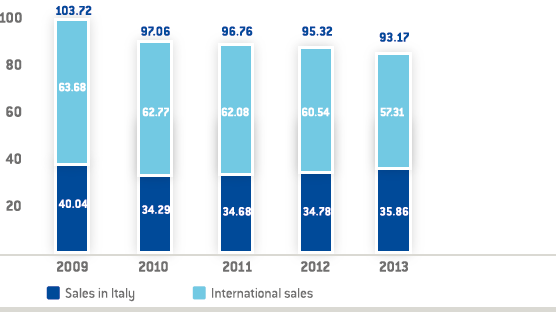

Eni gas sales (93.17 bcm) were down by 2.3% compared to 2012. When excluding the effect of the divestment of Galp, gas sales were broadly in line with the previous year. Eni’s sales in the domestic market increased by 1.08 bcm driven by higher spot sales and by higher sales to importers in Italy (up 1.94 bcm). This positive trend was more than offset by slightly lower volumes marketed in the main European markets (down 5.61 bcm), particularly in Benelux, Iberian Peninsula and the UK due to declining demand and competitive pressure.

Electricity sales of 35.05 TWh decreased by 7.53 TWh from 2012, down 17.7%.

In 2013 capital expenditure of €232 million mainly concerned the revamping activities of the cogeneration plant of Bolgiano and the development of its heating cable system (€39 million), the flexibility and upgrading of combined cycle power stations (€82 million) as well as gas marketing initiatives (€88 million).

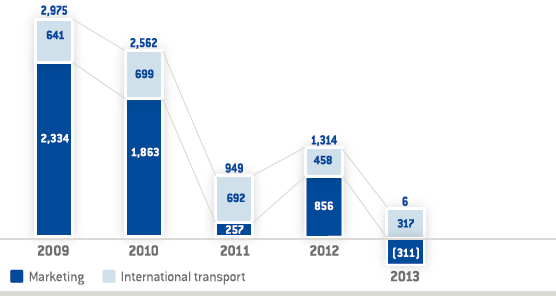

Adjusted proforma EBITDA (€ million)

Worldwide gas sales (bcm)

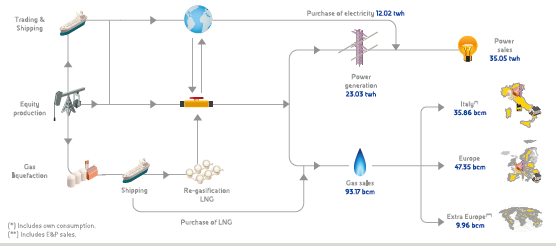

Eni’s Gas & Power segment engages in all phases of the natural gas value chain: supply, trading and marketing of natural gas and and LNG. This segment also includes power generation and marketing of electricity. Eni’s leading position in the European gas market is ensured by a set of competitive advantages, including our multi-Country approach, long-term gas availability, access to infrastructures, market knowledge and a strong customer base, in addition to long term relations with producing countries. Furthermore, integration with our upstream operations provides valuable growth options whereby the Company targets to monetize its large gas reserves.