Main data

Key financial data

|

Key financial data (a) |

||||||||||||||

|

(€ million) |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 (b) |

2013 |

||||

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Net sales from operations |

57,498 |

73,692 |

86,071 |

87,204 |

108,082 |

83,227 |

98,523 |

109,589 |

128,592 |

114,722 |

||||

|

of which: continuing operations |

|

|

|

|

106,978 |

81,932 |

96,617 |

107,690 |

127,220 |

114,722 |

||||

|

Group operating profit |

12,399 |

16,664 |

19,336 |

18,739 |

18,517 |

12,055 |

16,111 |

17,435 |

15,962 |

8,856 |

||||

|

Special items |

(448) |

(1,210) |

88 |

(620) |

2,034 |

1,295 |

2,290 |

1,567 |

4,795 |

3,046 |

||||

|

Profit (loss) on stock |

631 |

1,942 |

1,059 |

885 |

936 |

(345) |

(881) |

(1,113) |

(17) |

716 |

||||

|

Group adjusted operating profit |

12,582 |

17,396 |

20,483 |

19,004 |

21,487 |

13,005 |

17,520 |

17,889 |

20,740 |

12,618 |

||||

|

Adjusted operating profit – continuing operations |

|

|

|

|

21,322 |

12,722 |

16,845 |

17,230 |

19,798 |

12,618 |

||||

|

Exploration & Production |

8,202 |

12,649 |

15,521 |

13,770 |

17,166 |

9,489 |

13,898 |

16,075 |

18,537 |

14,646 |

||||

|

Gas & Power |

3,448 |

3,783 |

4,117 |

4,414 |

1,778 |

2,022 |

1,268 |

(247) |

356 |

(663) |

||||

|

Refining & Marketing |

923 |

1,210 |

794 |

292 |

555 |

(381) |

(181) |

(539) |

(321) |

(482) |

||||

|

Versalis |

263 |

261 |

219 |

116 |

(382) |

(441) |

(96) |

(273) |

(483) |

(386) |

||||

|

Engineering & Construction |

215 |

314 |

508 |

840 |

1,041 |

1,120 |

1,326 |

1,443 |

1,474 |

(84) |

||||

|

Other activities |

(223) |

(296) |

(299) |

(207) |

(244) |

(258) |

(205) |

(226) |

(222) |

(210) |

||||

|

Corporate and financial companies |

(187) |

(384) |

(244) |

(195) |

(282) |

(342) |

(265) |

(266) |

(325) |

(332) |

||||

|

Impact of unrealized intragroup profit elimination and consolidation adjustments |

(59) |

(141) |

(133) |

(26) |

1,690 |

1,513 |

1,100 |

1,263 |

782 |

129 |

||||

|

Adjusted operating profit – discontinued operations |

|

|

|

|

165 |

283 |

675 |

659 |

942 |

|

||||

|

Group net profit |

7,059 |

8,788 |

9,217 |

10,011 |

8,825 |

4,367 |

6,318 |

6,860 |

7,790 |

5,160 |

||||

|

of which: continuing operations |

|

|

|

|

8,996 |

4,488 |

6,252 |

6,902 |

4,200 |

5,160 |

||||

|

discontinued operations |

|

|

|

|

(171) |

(121) |

66 |

(42) |

3,590 |

|

||||

|

Group adjusted net profit |

6,645 |

9,251 |

10,401 |

9,569 |

10,164 |

5,207 |

6,869 |

6,969 |

7,325 |

4,433 |

||||

|

of which: continuing operations |

|

|

|

|

10,315 |

5,321 |

6,770 |

6,938 |

7,130 |

4,433 |

||||

|

discontinued operations |

|

|

|

|

(151) |

(114) |

99 |

31 |

195 |

|

||||

|

Net cash provided by operating activities |

12,500 |

14,936 |

17,001 |

15,517 |

21,801 |

11,136 |

14,694 |

14,382 |

12,371 |

10,969 |

||||

|

of which: continuing operations |

|

|

|

|

21,506 |

10,755 |

14,140 |

13,763 |

12,356 |

10,969 |

||||

|

discontinued operations |

|

|

|

|

295 |

381 |

554 |

619 |

15 |

|

||||

|

Capital expenditure |

7,499 |

7,414 |

7,833 |

10,593 |

14,562 |

13,695 |

13,870 |

13,438 |

13,517 |

12,750 |

||||

|

of which: continuing operations |

|

|

|

|

12,935 |

12,216 |

12,450 |

11,909 |

12,761 |

12,750 |

||||

|

discontinued operations |

|

|

|

|

1,627 |

1,479 |

1,420 |

1,529 |

756 |

|

||||

|

Shareholders’ equity including non-controlling interests |

35,540 |

39,217 |

41,199 |

42,867 |

48,510 |

50,051 |

55,728 |

60,393 |

62,558 |

61,174 |

||||

|

Net borrowings |

10,443 |

10,475 |

6,767 |

16,327 |

18,376 |

23,055 |

26,119 |

28,032 |

15,511 |

15,428 |

||||

|

Leverage |

0.29 |

0.27 |

0.16 |

0.38 |

0.38 |

0.46 |

0.47 |

0.46 |

0.25 |

0.25 |

||||

|

Net capital employed |

45,983 |

49,692 |

47,966 |

59,194 |

66,886 |

73,106 |

81,847 |

88,425 |

78,069 |

76,602 |

||||

|

Exploration & Production |

16,770 |

19,109 |

17,783 |

23,826 |

31,362 |

32,455 |

37,646 |

42,024 |

42,394 |

45,721 |

||||

|

Gas & Power |

19,554 |

20,075 |

19,713 |

21,333 |

9,636 |

11,024 |

12,931 |

12,367 |

11,124 |

9,735 |

||||

|

Snam |

|

|

|

|

11,918 |

13,730 |

14,415 |

15,393 |

|

|

||||

|

Refining & Marketing |

5,081 |

5,993 |

5,631 |

7,675 |

7,379 |

8,105 |

8,321 |

9,188 |

8,846 |

7,969 |

||||

|

Versalis |

2,076 |

2,018 |

1,953 |

2,228 |

1,915 |

1,774 |

1,978 |

2,252 |

2,557 |

2,656 |

||||

|

Engineering & Construction |

2,403 |

2,844 |

3,399 |

4,313 |

5,022 |

6,566 |

7,610 |

8,217 |

9,992 |

9,616 |

||||

|

Corporate financial companies and other activities |

277 |

2 |

(95) |

294 |

24 |

(192) |

(527) |

(393) |

3,659 |

1,382 |

||||

|

Impact of unrealized intragroup profit elimination |

(178) |

(349) |

(418) |

(475) |

(370) |

(356) |

(527) |

(623) |

(503) |

(477) |

||||

Key market indicators

|

Key market indicators |

|

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

||||||

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Average price of Brent dated crude oil (a) |

|

38.22 |

54.38 |

65.14 |

72.52 |

96.99 |

61.51 |

79.47 |

111.27 |

111.58 |

108.66 |

||||||

|

Average EUR/USD exchange rate (b) |

|

1.244 |

1.244 |

1.256 |

1.371 |

1.471 |

1.393 |

1.327 |

1.392 |

1.285 |

1.328 |

||||||

|

Average price in euro of Brent dated crude oil |

|

30.72 |

43.71 |

51.86 |

52.90 |

65.93 |

44.16 |

59.89 |

79.94 |

86.83 |

81.82 |

||||||

|

Average European refining margin (c) |

|

4.35 |

5.78 |

3.79 |

4.52 |

6.49 |

3.13 |

2.66 |

2.06 |

4.83 |

2.64 |

||||||

|

Average European refining margin Brent/Ural (c) |

|

7.03 |

8.33 |

6.50 |

6.45 |

8.85 |

3.56 |

3.47 |

2.90 |

4.94 |

2.60 |

||||||

|

Euribor - three-month euro rate |

(%) |

2.1 |

2.2 |

3.1 |

4.3 |

4.6 |

1.2 |

0.8 |

1.4 |

0.6 |

0.2 |

||||||

Selected operating data

|

Selected operating data |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

|||||

|

|||||||||||||||

|

Corporate (a) |

|

|

|

|

|

|

|

|

|

|

|

||||

|

Employees at period end |

(number) |

71,572 |

71,773 |

72,850 |

75,125 |

71,714 |

71,461 |

73,768 |

72,574 |

77,838 |

82,289 |

||||

|

of which: - women |

|

10,326 |

10,620 |

10,841 |

10,977 |

11,611 |

11,955 |

12,161 |

12,542 |

12,860 |

13,601 |

||||

|

- outside Italy |

|

32,691 |

34,036 |

35,818 |

38,634 |

41,971 |

42,633 |

45,967 |

45,516 |

51,034 |

55,507 |

||||

|

Female managers |

(%) |

12.5 |

12.4 |

13.5 |

14.1 |

16.3 |

17.3 |

18.0 |

18.5 |

18.9 |

19.4 |

||||

|

Employees injury frequency rate |

(number of accidents per million of worked hours) |

3.99 |

2.74 |

2.45 |

1.93 |

1.22 |

0.84 |

0.80 |

0.65 |

0.57 |

0.40 |

||||

|

Contractors injury frequency rate |

|

7.84 |

2.59 |

1.54 |

1.45 |

1.09 |

0.97 |

0.71 |

0.57 |

0.45 |

0.32 |

||||

|

Fatality index |

(fatal injuries per one hundred millions of worked hours) |

5.64 |

3.38 |

2.31 |

2.97 |

2.75 |

1.20 |

4.77 |

1.94 |

1.10 |

0.98 |

||||

|

Oil spills due to operations |

(barrels) |

7,813 |

6,908 |

6,151 |

6,731 |

4,749 |

6,259 |

4,269 |

7,295 |

3,759 |

1,901 |

||||

|

Direct GHG emission |

(mmtonnes CO2eq) |

58.34 |

61.85 |

60.72 |

67.25 |

59.59 |

55.49 |

58.26 |

49.13 |

52.50 |

47.30 |

||||

|

R&D expenditure (b) |

(€ million) |

257 |

204 |

222 |

208 |

211 |

233 |

218 |

190 |

211 |

197 |

||||

|

Exploration & Production |

|

|

|

|

|

|

|

|

|

|

|||||

|

Proved reserves of hydrocarbons |

(mmboe) |

7,218 |

6,837 |

6,436 |

6,370 |

6,600 |

6,571 |

6,843 |

7,086 |

7,166 |

6,535 |

||||

|

Reserve life index |

(years) |

12.1 |

10.8 |

10.0 |

10.0 |

10.0 |

10.2 |

10.3 |

12.3 |

11.5 |

11.1 |

||||

|

Production of hydrocarbons |

(kboe/d) |

1,624 |

1,737 |

1,770 |

1,736 |

1,797 |

1,769 |

1,815 |

1,581 |

1,701 |

1,619 |

||||

|

Gas & Power |

|

|

|

|

|

|

|

|

|

|

|

||||

|

Sales of consolidated companies (including own consumption) |

(bcm) |

76.49 |

82.62 |

85.76 |

84.83 |

89.32 |

89.60 |

82.00 |

84.05 |

84.30 |

83.60 |

||||

|

Sales of Eni’s affiliates (Eni’s share) |

|

5.84 |

7.08 |

7.65 |

8.74 |

8.91 |

7.95 |

9.41 |

9.85 |

8.29 |

6.96 |

||||

|

Total sales and own consumption (G&P) |

|

82.33 |

89.70 |

93.41 |

93.57 |

98.23 |

97.55 |

91.41 |

93.90 |

92.59 |

90.56 |

||||

|

E&P sales in Europe and in the Gulf of Mexico |

|

4.70 |

4.51 |

4.69 |

5.39 |

6.00 |

6.17 |

5.65 |

2.86 |

2.73 |

2.61 |

||||

|

Worldwide gas sales |

|

87.03 |

94.21 |

98.10 |

98.96 |

104.23 |

103.72 |

97.06 |

96.76 |

95.32 |

93.17 |

||||

|

Electricity sold |

(TWh) |

16.95 |

27.56 |

31.03 |

33.19 |

29.93 |

33.96 |

39,54 |

40.28 |

42.58 |

35.05 |

||||

|

Refining & Marketing |

|

|

|

|

|

|

|

|

|

|

|||||

|

Throughputs on own account |

(mmtonnes) |

37.69 |

38.79 |

38.04 |

37.15 |

35.84 |

34.55 |

34,80 |

31.96 |

30.01 |

27.38 |

||||

|

Balanced capacity of wholly-owned refineries |

(kbbl/d) |

504 |

524 |

534 |

544 |

737 |

747 |

757 |

767 |

767 |

787 |

||||

|

Sales of refined products |

(mmtonnes) |

53.54 |

51.63 |

51.13 |

50.15 |

49.16 |

45.59 |

46.80 |

45.02 |

48.33 |

43.49 |

||||

|

Retail sales in Europe |

|

14.40 |

12.42 |

12.48 |

12.65 |

12.03 |

12.02 |

11,73 |

11.37 |

10.87 |

9.69 |

||||

|

Service stations at year end |

(units) |

9,140 |

6,282 |

6,294 |

6,440 |

5,956 |

5,986 |

6,167 |

6,287 |

6,384 |

6,386 |

||||

|

Average throughput per service station |

(kliters/y) |

1,970 |

2,479 |

2,470 |

2,486 |

2,502 |

2,477 |

2,353 |

2,206 |

2,064 |

1,828 |

||||

|

Versalis |

|

|

|

|

|

|

|

|

|

|

|

||||

|

Production |

(ktonnes) |

7,118 |

7,282 |

7,072 |

8,795 |

7,372 |

6,521 |

7,220 |

6,245 |

6,090 |

5,817 |

||||

|

of which: - Intermediates |

4,236 |

4,450 |

4,275 |

5,688 |

5,110 |

4,350 |

4,860 |

4,101 |

3,595 |

3,462 |

|||||

|

- Polymers |

|

2,882 |

2,832 |

2,797 |

3,107 |

2,262 |

2,171 |

2,360 |

2,144 |

2,495 |

2,355 |

||||

|

Average plant utilization rate |

(%) |

75.2 |

78.4 |

76.4 |

80.6 |

68.6 |

65.4 |

72.9 |

65.3 |

66.7 |

65.3 |

||||

|

Engineering & Construction |

|

|

|

|

|

|

|

|

|

|

|||||

|

Orders acquired |

(€ million) |

5,784 |

8,395 |

11,172 |

11,845 |

13,860 |

9,917 |

12,935 |

12,505 |

13,391 |

10,653 |

||||

|

Order backlog at year end |

8,521 |

10,122 |

13,191 |

15,390 |

19,105 |

18,370 |

20,505 |

20,417 |

19,739 |

17,514 |

|||||

Share data

|

Share data |

|

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

||||||||||||

|

|||||||||||||||||||||||

|

Net profit (a) (b) |

(€) |

1.87 |

2.34 |

2.49 |

2.73 |

2.43 |

1.21 |

1.74 |

1.89 |

2.15 |

1.42 |

||||||||||||

|

Net profit - continuing operations (a) (b) (*) |

|

|

|

|

|

2.47 |

1.24 |

1.72 |

1.90 |

1.16 |

1.42 |

||||||||||||

|

Dividend |

(€ million) |

0.90 |

1.10 |

1.25 |

1.30 |

1.30 |

1.00 |

1.00 |

1.04 |

1.08 |

1.10 |

||||||||||||

|

Dividend pertaining to the year |

|

3,384 |

4,086 |

4,594 |

4,750 |

4,714 |

3,622 |

3,622 |

3,695 |

3,840 |

3,949 |

||||||||||||

|

Cash flow |

(€) |

3.31 |

3.97 |

4.59 |

4.23 |

5.99 |

3.07 |

4.06 |

3.97 |

3.41 |

3.52 |

||||||||||||

|

Dividend yield (c) |

(%) |

4.9 |

4.7 |

5.0 |

5.3 |

7.6 |

5.8 |

6.1 |

6.6 |

5.9 |

6.5 |

||||||||||||

|

Net profit per ADR (d) (*) |

(US$) |

4.66 |

5.81 |

6.26 |

7.49 |

7.27 |

3.45 |

4.59 |

5.29 |

2.98 |

3.77 |

||||||||||||

|

Dividend per ADR (d) |

|

2.17 |

2.74 |

3.14 |

3.56 |

3.82 |

2.79 |

2.65 |

2.90 |

2.78 |

2.83 |

||||||||||||

|

Cash flow per ADR (d) |

|

8.96 |

9.40 |

11.53 |

11.60 |

17.63 |

8.56 |

10.77 |

11.05 |

8.77 |

9.04 |

||||||||||||

|

Dividend yield per ADR (c) |

(%) |

5.0 |

4.7 |

5.0 |

5.3 |

7.6 |

5.8 |

6.1 |

6.6 |

5.8 |

4.6 |

||||||||||||

|

Pay-out |

|

48 |

46 |

50 |

47 |

53 |

81 |

57 |

55 |

50 |

77 |

||||||||||||

|

Number of shares at period-end representing share capital |

(million shares) |

4,004.4 |

4,005.4 |

4,005.4 |

4,005.4 |

4,005.4 |

4,005.4 |

4,005.4 |

4,005.4 |

3,634.2 |

3,634.2 |

||||||||||||

|

Average number of shares outstanding in the year (e) (fully diluted) |

|

3,771.7 |

3,763.4 |

3,701.3 |

3,669.2 |

3,638.9 |

3,622.4 |

3,622.5 |

3,622.7 |

3,622.8 |

3,622.8 |

||||||||||||

|

TSR |

(%) |

28.5 |

35.3 |

14.8 |

3.2 |

(29.1) |

13.7 |

(2.2) |

5.1 |

22.0 |

1.3 |

||||||||||||

|

Share information |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

|||||||

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Share price - Milan Stock Exchange |

|

|

|

|

|

|

|

|

|

|

|||||||

|

High |

(€) |

18.75 |

24.96 |

25.73 |

28.33 |

26.93 |

18.35 |

18.56 |

18.42 |

18.70 |

19.48 |

||||||

|

Low |

|

14.72 |

17.93 |

21.82 |

22.76 |

13.80 |

12.30 |

14.61 |

12.17 |

15.25 |

15.29 |

||||||

|

Average |

|

16.94 |

21.60 |

23.83 |

25.10 |

21.43 |

16.59 |

16.39 |

15.95 |

17.18 |

17.57 |

||||||

|

End of the period |

|

18.42 |

23.43 |

25.48 |

25.05 |

16.74 |

17.80 |

16.34 |

16.01 |

18.34 |

17.49 |

||||||

|

ADR price (a) - New York Stock Exchange |

|

|

|

|

|

|

|

|

|

||||||||

|

High |

(US$) |

126.45 |

151.35 |

67.69 |

78.29 |

84.14 |

54.45 |

53.89 |

53.74 |

49.44 |

52.12 |

||||||

|

Low |

|

92.35 |

118.50 |

54.65 |

60.22 |

37.22 |

31.07 |

35.37 |

32.98 |

36.85 |

40.39 |

||||||

|

Average |

|

105.60 |

134.02 |

59.97 |

68.80 |

63.38 |

46.36 |

43.56 |

44.41 |

44.24 |

46.68 |

||||||

|

End of the period |

|

125.84 |

139.46 |

67.28 |

72.43 |

47.82 |

50.61 |

43.74 |

41.27 |

49.14 |

48.49 |

||||||

|

Average daily exchanged shares |

(million shares) |

20.0 |

28.5 |

26.2 |

30.5 |

28.7 |

27.9 |

20.7 |

22.9 |

15.6 |

15.4 |

||||||

|

Value |

(€ million) |

338.7 |

620.7 |

619.1 |

773.1 |

610.4 |

461.7 |

336.0 |

355.0 |

267.0 |

271.4 |

||||||

|

Number of shares outstanding at period end (b) |

(million shares) |

3,770.0 |

3,727.3 |

3,680.4 |

3,656.8 |

3,622.4 |

3,622.4 |

3,622.7 |

3,622.7 |

3,622.8 |

3,622.8 |

||||||

|

Market capitalization (c) |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

EUR |

(billion) |

69.4 |

87.3 |

93.8 |

91.6 |

60.6 |

64.5 |

59.2 |

58.0 |

66.4 |

63.4 |

||||||

|

USD |

|

94.9 |

104.0 |

123.8 |

132.4 |

86.6 |

91.7 |

79.2 |

75.0 |

87.7 |

87.4 |

||||||

|

Data on Eni share placement |

1995 |

1996 |

1997 |

1998 |

2001 |

|||

|

||||||||

|

|

|

|

|

|

|

|

||

|

Offer price |

(€/share) |

5.42 |

7.40 |

9.90 |

11.80 |

13.60 |

||

|

Number of share placed |

(million shares) |

601.9 |

647.5 |

728.4 |

608.1 |

200.1 |

||

|

of which: through bonus share |

|

|

1.9 |

15.0 |

24.4 |

39.6 |

||

|

Percentage of share capital (a) |

(%) |

15.0 |

16.2 |

18.2 |

15.2 |

5.0 |

||

|

Proceeds |

(€ million) |

3.254 |

4,596 |

6,869 |

6,714 |

2,721 |

||

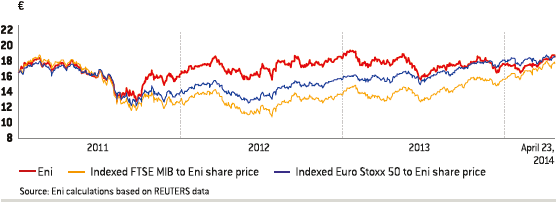

Eni share price in Milan - (December 31, 2010 - April 23, 2014)

Eni ADR price in New York - (December 31, 2010 - April 23, 2014)

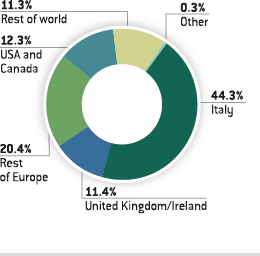

Shareholders distribution by geographic area(*)

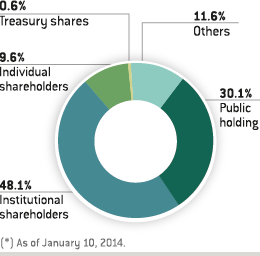

Class of shareholders(*)