Activity areas

Engineering & Construction Offshore

In 2013 revenues amounted to €5,094 million, decreasing by 2.2% from 2012, due to lower levels of activity in the North Sea, Kazakhstan and Australia.

Orders acquired in the year amounted to €5,777 million (€7,477 million in 2012), mainly related to: (i) EPCI contract on behalf of Total Upstream Nigeria Ltd, for the development of the Egina field in Nigeria that includes engineering, procurement, fabrication, installation and pre-commissioning of subsea pipelines for oil and gas production and gas export, flexible jumpers and umbilicals; (ii) contract on behalf of Burullus Gas Company for the development of the West Delta Deep Marine – Phase IXa Project, about 90 kilometers off the Mediterranean Coast of Egypt. The project is aimed to the installation of subsea facilities (in water depths up to 850 meters) in the West Delta Deep Marine Concession, where Saipem had already successfully performed some previous phases of subsea field development; (iii) EPCI contract on behalf of ExxonMobil pertaining to the engineering, procurement, fabrication and installation of subsea pipelines of production and water injection, rigid jumpers and other related subsea structures as part of Kizomba Satellites Phase 2 project, undertaken in the Angolan offshore.

As part of the Trunkline and Production Flowlines project committed by the North Caspian Sea Production Sharing Agreement Consortium in Kazakhstan (in which Eni retains an interest of 16.81%), which provided the engineering, laying and commissioning of pipelines and other facilities, following leakages that were detected in a section of the onshore pipelines, Saipem was requested by the clients to address the issue under the guarantee. Saipem, presuming not to be obliged to perform those works, has invited the client to investigate other possible causes of the issue identified. At present, no dispute is underway between Saipem and the Consortium.

In 2013 Saipem continued to pursue the development of state of the art technologies for working in deep and ultra-deep waters, the design of floating liquefaction facilities, the development of new techniques and equipment for the installation and grounding of underwater pipes in extreme conditions. In particular, the innovative “Subsea Processing” system and floating liquefaction units (FLNG) were developed. In the process of subsea pipeline construction, new equipment was applied successfully, which enhanced the process and the quality of steel pipes’ soldering with carbon and inoxidable materials.

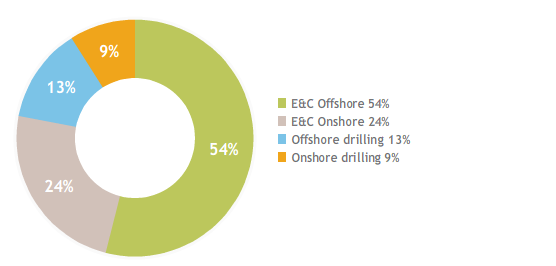

Orders acquired (€10,653 million)

Engineering & Construction Onshore

In 2013 revenues amounted to €4,619 million, registering a decrease of 24.4% from 2012, due to lower levels of activity in Northern and Western Africa and Middle East. Orders acquired during the year amounted to €2,566 million (€3,972 million in 2012). Among the main orders acquired were: (i) the EPC contract on behalf of Dangote Fertilizer for the realization of a new ammonia and urea production complex to be realized in Edo State, Nigeria. The contract encompasses the construction of two twin production streams and related utilities and off-site facilities; (ii) the EPC contract on behalf of Star Refinery AS, for the realization of Socar Refinery in Turkey, encompassing the engineering, procurement and construction of a refinery and three crude refinery jetties, to be built in the area adjacent to the Petkim Petrochemical facility; (iii) the EPC contract for Eni related to the improvements to the storage infrastructure for crude oil of Tempa Rossa field, in Italy.

R&D activities aiming at improving proprietary process technologies and increasing the company’s environmental services portfolio concerned: (i) the study on the improvement of propriety technology for the production of urea, with the development of a new process “Urea Zero Emission”; (ii) the launch of the innovative project in order to improve energy efficiency.

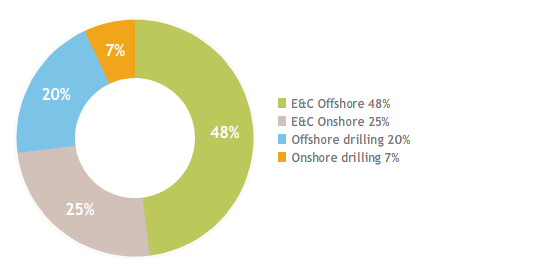

Order backlog (€17,514 million)

Offshore drilling

In 2013 revenues amounted to €1,177 million, with an increase of 8.1% from 2012. This was due to the entry in full activity of the semisubmersible rigs Scarabeo 8, Scarabeo 3 and Scarabeo 6 and the beginning of operations of Ocean Spur vessels. Orders acquired in the year amounted to €1,401 million (€1,025 million in 2012), mainly related to: (i) five-year contract extension with Eni for the charter of the drillship Saipem 10000 starting from the third quarter of 2014 for worldwide drilling activity operations; (ii) one-year contract extension on behalf of IEOC, for the utilization of the semi-submersible Scarabeo 4 in Egypt; (iii) two-year contract extension on behalf of Eni for the charter of the Saipem TAD for drilling activity offshore Congo.

Onshore drilling

In 2013 revenues amounted to €721 million, slightly decreasing from 2012. Lower levels of activities in Algeria were almost completely absorbed by higher levels of activities in Saudi Arabia, Kazakhstan and Mauritania. Orders acquired in the year amounted to €909 million (€917 million in 2012), mainly related to: (i) three-year contract extension on behalf of Eni Congo for the management of a client’s plant; (ii) the extension of the drilling contracts with variable duration, on behalf of several clients, in South America; (iii) new contracts by several clients, signed under different terms ranging from six months to five years, for the utilization of 17 rigs in Middle East, the Caspian sea, South America, West Africa, Turkey and Ukraine. Among these newly contracted rigs, two will be working for Shell under a long term Global Framework, engaging Saipem in a call-off agreement to facilitate new Country entries and, for exploration purposes, provide onshore drilling services worldwide, at pre-agreed terms and conditions.

|

Orders acquired |

|||||

|

|

|

|

|

|

|

|

(€ million) |

2011 |

2012 |

2013 |

Change |

% Ch. |

|

|

12,505 |

13,391 |

10,653 |

(2,738) |

(20.4) |

|

Engineering & Construction Offshore |

6,131 |

7,477 |

5,777 |

(1,700) |

(22.7) |

|

Engineering & Construction Onshore |

5,006 |

3,972 |

2,566 |

(1,406) |

(35.4) |

|

Offshore drilling |

780 |

1,025 |

1,401 |

376 |

36.7 |

|

Onshore drilling |

588 |

917 |

909 |

(8) |

(0.9) |

|

of which: |

|

|

|

|

|

|

- Eni |

822 |

631 |

1,514 |

883 |

.. |

|

- Third parties |

11,683 |

12,760 |

9,139 |

(3,621) |

(28.4) |

|

of which: |

|

|

|

|

|

|

- Italy |

1,116 |

485 |

591 |

106 |

21.9 |

|

- Outside Italy |

11,389 |

12,906 |

10,062 |

(2,844) |

(22.0) |

|

Order backlog |

|||||

|

|

|

|

|

|

|

|

(€ million) |

2011 |

2012 |

2013 |

Change |

% Ch. |

|

|

20,417 |

19,739 |

17,514 |

(2,225) |

(11.3) |

|

Engineering & Construction Offshore |

6,600 |

8,721 |

8,447 |

(274) |

(3.1) |

|

Engineering & Construction Onshore |

9,604 |

6,701 |

4,436 |

(2,265) |

(33.8) |

|

Offshore drilling |

3,301 |

3,238 |

3,390 |

152 |

4.7 |

|

Onshore drilling |

912 |

1,079 |

1,241 |

162 |

15.0 |

|

of which: |

|

|

|

|

|

|

- Eni |

2,883 |

2,526 |

2,261 |

(265) |

(10.5) |

|

- Third parties |

17,534 |

17,213 |

15,253 |

(1,960) |

(11.4) |

|

of which: |

|

|

|

|

|

|

- Italy |

1,816 |

1,719 |

784 |

(935) |

(54.4) |

|

- Outside Italy |

18,601 |

18,020 |

16,730 |

(1,290) |

(7.2) |