overview

the year 2014

Scroll down for more content

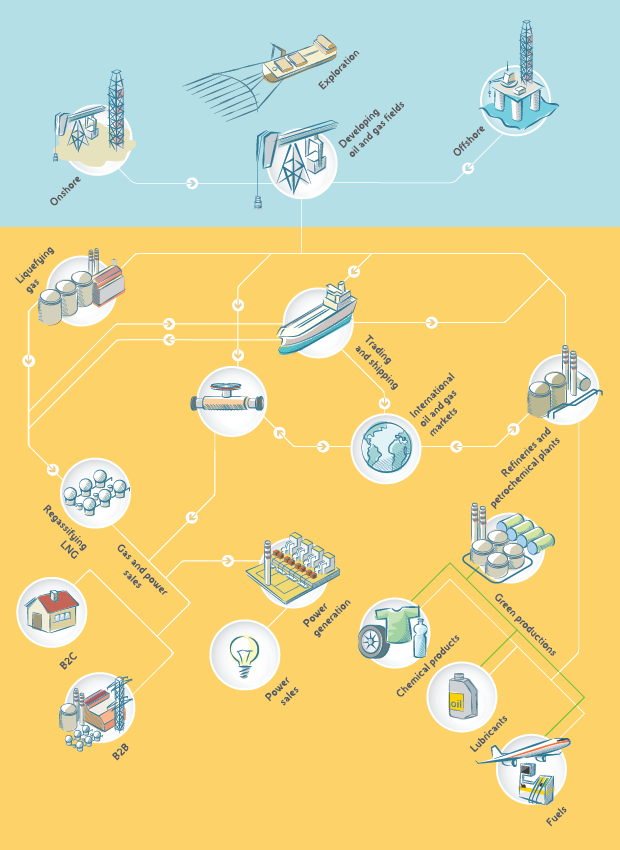

Eni's activities

upstream

Eni engages in oil and natural gas exploration, field development and production, mainly in Italy, Algeria, Angola, Congo, Egypt, Ghana, Libya, Mozambique, Nigeria, Norway, Kazakhstan, UK, The United States and Venezuela, overall in 40 countries.

mid-downstream

Eni sells in the European market basing on the portfolio availability of equity oil and long-term contracts; sells LNG on a global scale. Produces and sells electricity through gas plants.

Through refineries and chemical plants, Eni processes crude oil and other oil-based feedstock to produce fuels, lubricants and chemical products that are supplied to wholesalers or through retail networks or distributors.

Eni engages in the trading of oil, natural gas, LNG and electricity.

Highlights 2014

In 2014, in spite of an unfavourable trading environment, Eni delivered excellent results underpinned by record cash flow generation. The performance was driven by the increased contribution from upstream production and the accelerated restructuring of the mid and downstream businesses.

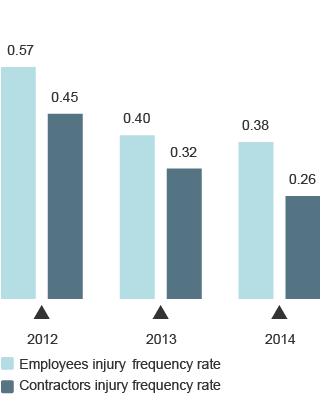

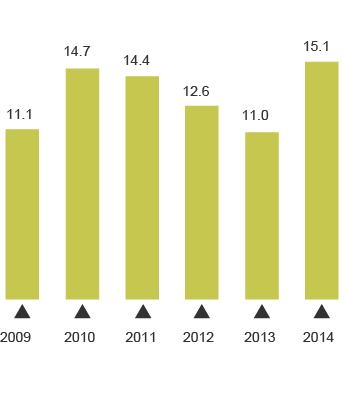

Injury frequency rate (No. of accidents per million of worked hours)

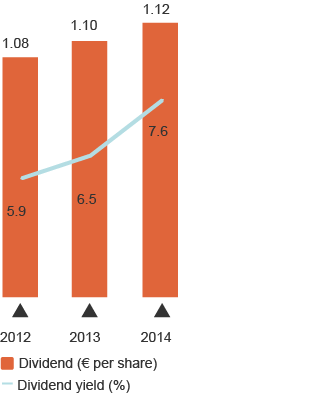

Dividend and dividend yield

Operating cash ow(€ billion)

Operative e fficiency

2014 net borrowings evolution(€ billion)

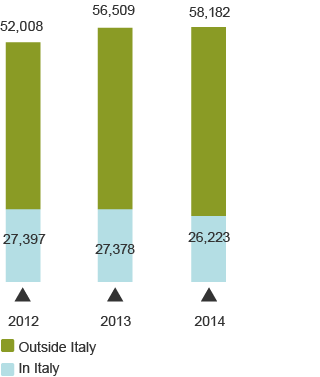

Employees at period end (number)