integrated

annual report

annual report

creating value

Scroll down for more content

Materiality and stakeholder engagement

Eni’s materiality definition process

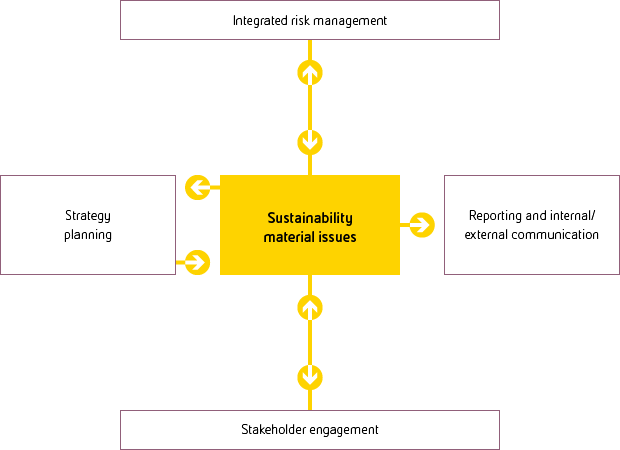

Materiality is the result of the identification and prioritization of the major sustainability issues which significantly affect the company’s ability to create value.

Eni’s materiality definition process aims to ensure that the material issues are both shared with the highest decision levels and their integration is also taken into account in all the processes starting from the risk management process, strategy planning, stakeholder engagement, reporting and internal/external communication, to the implementation of operational decisions.

Materiality integration in company’s processes

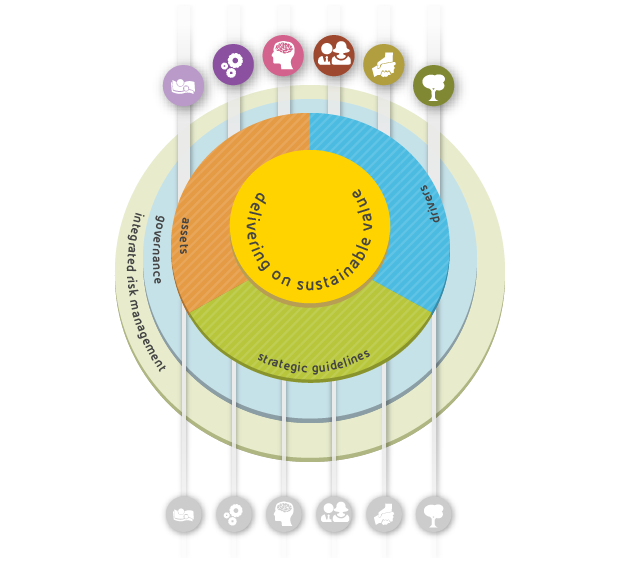

Business model

Eni’s business model targets long-term value creation for its stakeholders by delivering on profitability and growth, efficiency and operational excellence and handling operational risks of its businesses, as well as environmental conservation, and local communities relationships, preserving health and safety of people working in Eni and with Eni, in respect of human rights, ethics and transparency.

The main capitals used by Eni (financial capital, productive capital, intellectual capital, natural capital, human capital, social and relationship capital) are classified in accordance with the criteria included in the “International IR Framework” published by the International Integrated Reporting Council (IIRC).

2014 financial results and sustainability performance rely on the responsible and efficient use of our capitals.

Hereunder is articulated the map of the main capitals exploited by Eni and actions positively effecting on their quality and availability. At the same time, the scheme evidences how the efficient use of capitals and related connections create value for the company and its stakeholders.

For detailed information on results associated to each capital and to the way by which each strategic target is achieved see the Integrated Performance tables.

(Mouse over or click on the image for more information.)

integrated risk management

Integrated risk management model across our businesses

governance

Framework of stringent and clear rules of governance

strategic guidelines

What are the strategic guidelines to use and develop our assets?

- profitable and selective upstream growth

- focus on core areas

- partnership with NOCs

- reduction of time-to-market

- operatorship

- gas supply contracts renegotiation

- development of green fuels and chemical products

- trading in energy commodities

- customer retention in gas and fuel markets

- efficiency and cost control

- reduction of capacity in downstream businesses

assets

What distintive assets for delivering Sustainable Value?

- solid and competitive resource base

- conventional oil&gas assets with low breakeven

- skills in exploration activities and upstream operations

- gas supply portfolio aligned to market conditions

- large and loyal customer base

- bio-refineries and green chemical plants

- eni brand

drivers

What principles for delivering Sustainable Value?

- integrity in business management

- support Countries development

- excellence in conducting operations

- innovation in developing competitive solutions to face complexity

- inclusiveness of Eni's people and development of know-how and skills

- integration of financial and non-financial issues in the company's plans and processes

financial capital | |

stock of capital

value creation for Eni

|

Eni’s main actions

value creation for Eni’s stakeholders

|

productive capital | |

stock of capital

value creation for Eni

|

Eni’s main actions

value creation for Eni’s stakeholders

|

intellectual capital | |

stock of capital

value creation for Eni

|

Eni’s main actions

value creation for Eni’s stakeholders

|

human capital | |

stock of capital

value creation for Eni

|

Eni’s main actions

value creation for Eni’s stakeholders

|

social and relationship capital | |

stock of capital

value creation for Eni

|

Eni’s main actions

value creation for Eni’s stakeholders

|

natural capital | |

stock of capital

value creation for Eni

|

Eni’s main actions

value creation for Eni’s stakeholders

|

Targets and performance drivers

2015-2018 targets

Cash flow and value generation

Increase the value of explorative resources

Growth in Upstream cash generation

Return to structural profitability in the Gas & Power business

Turnaround in Refining & Marketing and Chemical businesses

R&M: EBIT adjusted and cash flow from operation breakeven in 2015

Chemical: EBIT adjusted and cash flow from operation breakeven in 2016

Focus on efficiency

creating value

Transforming Eni, creating value

Eni is completing its transformation process. We are creating a more robust and resilient company, capable to continue to grow and generate value even in a low price scenario.

In 2014 we took major steps towards our target.

The first one was to pass from a divisional model to a fully integrated one. Secondly, we deeply reviewed our company’s cost structure and implemented a strategic program that allowed us to:

- Achieve positive results in gas & power one year in advance

- Progress the turnaround of refining & marketing and chemicals

- Beat our cash flow growth target

- And lower our leverage

This was done months ahead of the oil downturn, putting the company in a stronger position to face this challenging scenario.

In the 4 year plan, we are going to complete the actions started in 2014.

In practical terms:

- In exploration & production, we will continue to grow, leveraging on our distinctive exploration, our diversified portfolio, and our development approach aimed at minimizing time to market.

- In mid-downstream, we will complete our turnaround, reaching the structural breakeven in the next two years.

Our production will continue to increase substantially, with an average growth rate of 3,5%.

Exploration in the near term will be more focused on near field wells and appraisals, and will give us about 2 billion barrels of oil equivalent.

The successes of the past 7 years have increased eni’s potential by more than 10 billion barrels, corresponding to a growth of 35% in our resource base.

Upstream efficiency remains a key target, and we plan a self financing ratio growing from 106% in the next two years to 130% in 2017-18, at the top of our historical trend.

The resources come not only from the major find in Mozambique, but also from discoveries in other basins such as Angola, Congo, Indonesia, Ghana, Gabon and Ecuador.

In G&P we will complete the transformational plan that we accelerated last year.

In 2014, we reversed the previous year’s losses and reported a positive result of 300 mln €. In the 4 years plan we will continue to grow profitability. We will reach a structural positive EBIT result from 2016 and generate a cash contribution of €3billion over the 4YP.

In R&M, we reduced capacity by 30% lowering our average refineries’ break-even by $2/barrel. We will continue to cut capacity up to 50%, while improving operations in the remaining plants, reducing refinery break-even to $3/barrel. Thanks to these actions, R&M will reach EBIT and operating cash flow break even in 2015, while the Refining section will reach the target in 2017.

In chemicals, in 2014 we completed the rationalization of our sites. We will continue to grow in specialty products and improve the efficiency of our plants. EBIT and operating cash breakeven is confirmed in 2016.

Eni’s management team is fully committed to delivering its transformation process.

We firmly believe that at the end of this journey, eni will be a stronger and more flexible company, well positioned to create value growth even in a challenging market environment.

Competitive environment

A challenging market

In an extremely complex and dynamic international environment, geopolitical, technological and market factors have interacted rapidly, determining the change of the consolidated business models and making emerge new players and new growth areas (particularly in Asia and in the United States as well as, in the initial phase, in the Sub-Saharan Africa).

In the second half of the year, an unbalanced oil market, with an excess of supply in the context of weak demand, witnessed a fall in oil prices. The gas market, characterized in Europe by continued demand reduction, saw the growth of volumes exchanged in the spot market and continuing renegotiations of the take-or-pay contracts. In this scenario Eni’s strategic plan is focused on maximizing the value of its portfolio through the timely development of new fields and anticipated monetization of the discoveries. In the mid-downstream businesses, Eni confirms the strategy aiming at quick economic and financial rebalancing through cost discipline, continuing renegotiation of long-term gas supply contracts, restructuring of inefficient plants and product and marketing innovation.

Strategy

In order to cope with a radically changed price environment, the Company outlined for the next four-year period an action plan which comprises a number of rigorous initiatives and objectives in order to mitigate the impact of lower oil prices and to preserve a robust financial structure, particularly in the short-to-medium term. Against the backdrop of a low price environment, our primary target remains cash generation which will be underpinned by well-designed industrial actions, capital discipline, focus on upstream activities and a large disposal plan.

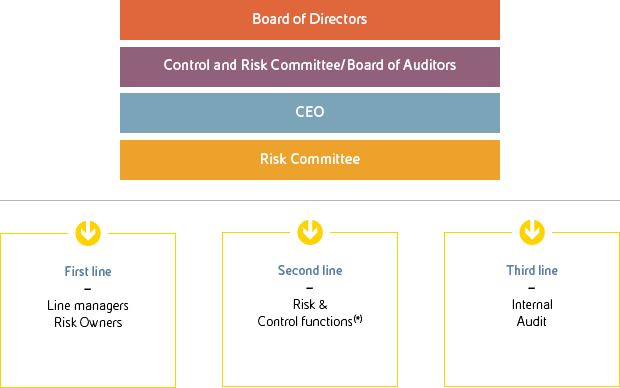

Risk management

Eni has developed and adopted a model for Integrated Risk Management (IRM) that targets to achieve an organic and comprehensive view of the Company main risks1 , greater consistency among internally-developed methodologies and tools to manage risks and a strengthening of the organization awareness, at any level, that suitable risk evaluation and mitigation may influence the delivery of Corporate targets and value.

Integrated Risk Management Model

The IRM has been defined and updated consistently with international principles and best practices. It is an integral part of the Internal Control and Risk Management System (see page 31) and is structured on three control levels.

The first level is represented by risk owners, whose responsibility lies in risk assumption and related treatment measures.

The second level concerns the risk control functions that cooperate in drafting the methodologies and risk management tools and perform control activities through structures that are independent from operating management.

The third level is represented by the independent assurance provider that provides independent certifications on the planning and functioning of risk management processes.

(1) Potential events that can affect Eni’s activities and whose occurrence could hamper the achievement of the main corporate objectives.

(*) Including Integrated Risk Management function.

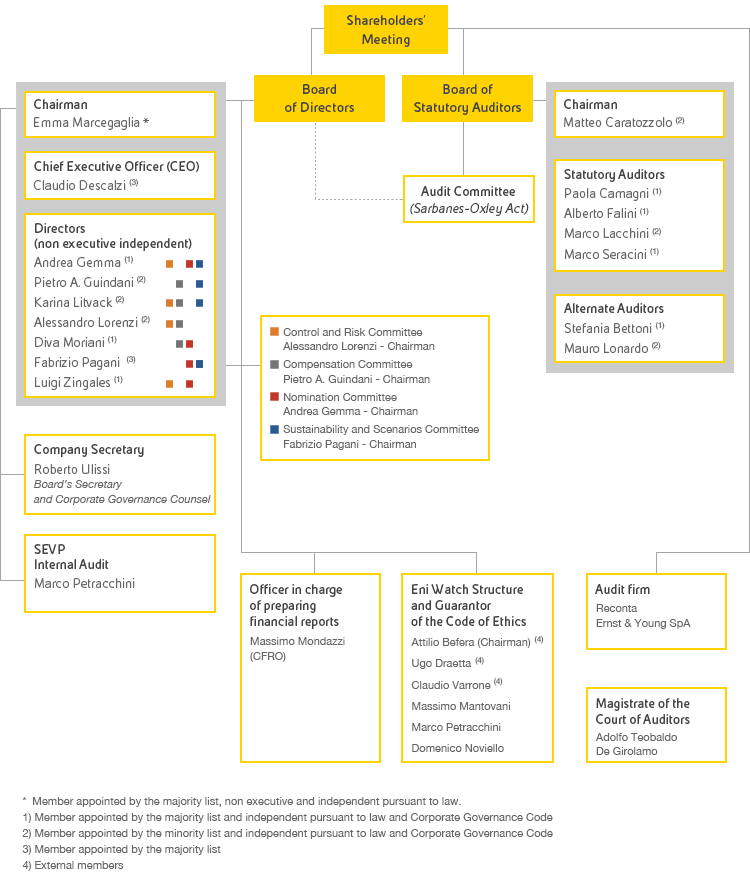

Governance

Integrity and transparency are the principles that have inspired Eni in designing its corporate governance system1, a key pillar of the Company’s business model. The governance system, flanking our business strategy, is intended to support the relationship of trust between Eni and its stakeholders and to help achieve our business goals, creating sustainable value for the long term.

Eni is committed to building a corporate governance system founded on excellence in our open dialogue with the market and all our stakeholders.

Ongoing, transparent communication with stakeholders is an essential tool for understanding their needs. It is part of our efforts to ensure the effective exercise of shareholder rights. With this in mind, between 2013 and 2014, Eni’s Chairman held a cycle of meetings with institutional investors and leading proxy advisors in Europe and the United States to foster a comprehensive understanding of the Company’s governance system, including in relation to the various regulatory systems.

(1) For more detailed information on the Eni corporate governance system, please see the Report on corporate governance and ownership structure, which is published on the Company’s website in the Governance section.