Marketing of refined products

In 2013, retail sales of refined products (43.49 mmtonnes) decreased by 4.84 mmtonnes from 2012, down 10%, due mainly to lower volumes sold to oil companies and traders outside Italy.

|

Product sales in Italy and outside Italy by market |

|||||

|

|

|

|

|

|

|

|

(mmtonnes) |

2011 |

2012 |

2013 |

Change |

% Ch. |

|

Retail |

8.36 |

7.83 |

6.64 |

(1.19) |

(15.2) |

|

Wholesale |

9.36 |

8.62 |

8.37 |

(0.25) |

(2.9) |

|

Chemicals |

1.71 |

1.26 |

1.32 |

0.06 |

4.8 |

|

Other sales |

6.58 |

6.08 |

7.01 |

0.93 |

15.3 |

|

Sales in Italy |

26.01 |

23.79 |

23.34 |

(0.45) |

(1.9) |

|

Retail rest of Europe |

3.01 |

3.04 |

3.05 |

0.01 |

0.3 |

|

Wholesale Rest of Europe |

3.84 |

3.96 |

4.23 |

0.27 |

6.8 |

|

Wholesale outside Italy |

0.43 |

0.42 |

0.43 |

0.01 |

2.4 |

|

Other sales |

11.73 |

17.12 |

12.44 |

(4.68) |

(27.3) |

|

Sales outside Italy |

19.01 |

24.54 |

20.15 |

(4.39) |

(17.9) |

|

TOTAL SALES OF REFINED PRODUCTS |

45.02 |

48.33 |

43.49 |

(4.84) |

(10.0) |

Retail sales in Italy

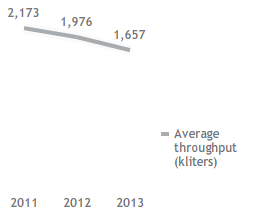

In 2013, retail sales in Italy of 6.64 mmtonnes decreased by approximately 1.19 mmtonnes, down 15.2%, from 2012 driven by lower consumption of gasoil and gasoline, in particular in highway service station reflecting the decline in freight transportation and increasing competitive pressure. Average gasoline and gasoil throughput (1,657 kliters) decreased by approximately 318 kliters from 2012. Eni’s retail market share for 2013 was 27.5%, down 3.7 percentage points from 2012 that benefitted by the summer marketing campaigns performed.

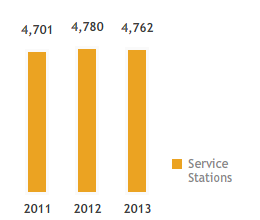

At December 31, 2013, Eni’s retail network in Italy consisted of 4,762 service stations, a decrease of 18 less stations from December 31, 2012 (4,780 service stations), resulting from the negative balance of the closing of service stations with low throughput (51 units), the release of one motorway concession, partially offset by the positive contribution of acquisitions/releases of lease concessions (34 units).

With reference to the promotional initiative “you&eni”, the loyalty program for customers launched in February 2010 for a five year period, the cards that made at least one transaction in the period were approximately 2.8 million at December 31, 2013 of which one million was represented by consumer payment and loyalty cards. Volumes sold to customers cumulating points on their card were approximately 37% of total throughputs (net of “iperself” sales that do not allow to accumulate points).

In 2013 even sales of premium fuels (fuels of the “Eni Blu+” line with high performance and lower environmental impact) were affected by the decline in domestic consumption and high price levels and were lower than the previous year. In particular, sales of Eni BluDiesel+ amounted to approximately 231 mmtonnes (approximately 278 mmliters) with a decline of approximately 61 ktonnes from 2012 and represented 5.3% of volumes of gasoil marketed by Eni’s retail network. At December 31, 2013, service stations marketing BluDiesel+ totaled 3,909 units (4,123 at year-end 2012) covering approximately 82% of Eni’s network. Retail sales of BluSuper+ amounted to 30 ktonnes (approximately 41 mmliters), decreasing by 4 ktonnes from 2012, and covered 1.6% of gasoline sales on Eni’s retail network (broadly in line with previous year). As of December 31, 2013, service stations marketing BluSuper+ totaled 2,171 units (2,505 at December 31, 2012), covering approximately 46% of Eni’s network.

In 2013 Eni continued the development of innovative and biofuels with proprietary additives and detergents that provide better gasoline and gasoil with a “keep clean” component.

Service Stations in Italy and Average Throughput (number)

Retail sales in the Rest of Europe

Retail sales in the Rest of Europe of 3.05 mmtonnes were basically stable (up 0.3% or 10 ktonnes). Volume additions in Germany and Austria were almost completely offset by lower sales in the Czech Republic and Hungary.

At December 31, 2013 Eni’s retail network in the Rest of Europe consisted of 1,624 service stations, an increase of 20 units from December 31, 2012 (1,604 service stations). The network evolution was as follows: (i) the closing of 25 low throughput service stations mainly in France; (ii) the positive balance of acquisitions/releases of lease concessions (26 units) in particular in Germany and Austria; (iii) the purchase of 18 service stations, in particular in France and Germany; (iv) the opening of one new outlet.

Average throughput (2,322 kliters) was in line with 2012 (2, 319 kliters).

|

Retail and wholesale sales of refined products |

|||||

|

|

|

|

|

|

|

|

(mmtonnes) |

2011 |

2012 |

2013 |

Change |

% Ch. |

|

Italy |

17.72 |

16.45 |

15.01 |

(1.44) |

(8.8) |

|

Retail sales |

8.36 |

7.83 |

6.64 |

(1.19) |

(15.2) |

|

Gasoline |

2.60 |

2.41 |

1.96 |

(0.45) |

(18.7) |

|

Gasoil |

5.45 |

5.08 |

4.33 |

(0.75) |

(14.8) |

|

LPG |

0.29 |

0.31 |

0.32 |

0.01 |

3.2 |

|

Others |

0.02 |

0.03 |

0.03 |

|

|

|

Wholesale sales |

9.36 |

8.62 |

8.37 |

(0.25) |

(2.9) |

|

Gasoil |

4.18 |

4.07 |

4.09 |

0.02 |

0.5 |

|

Fuel Oil |

0.46 |

0.33 |

0.24 |

(0.09) |

(27.3) |

|

LPG |

0.31 |

0.30 |

0.30 |

|

|

|

Gasoline |

0.19 |

0.20 |

0.25 |

0.05 |

25.0 |

|

Lubricants |

0.10 |

0.09 |

0.09 |

|

|

|

Bunker |

1.26 |

1.19 |

1.00 |

(0.19) |

(16.0) |

|

Jet fuel |

1.65 |

1.56 |

1.58 |

0.02 |

1.3 |

|

Other |

1.21 |

0.88 |

0.82 |

(0.06) |

(6.8) |

|

Outside Italy (retail+wholesale) |

7.28 |

7.42 |

7.71 |

0.29 |

3.9 |

|

Gasoline |

1.79 |

1.81 |

1.73 |

(0.08) |

(4.4) |

|

Gasoil |

3.82 |

3.96 |

4.23 |

0.27 |

6.8 |

|

Jet fuel |

0.49 |

0.44 |

0.51 |

0.07 |

15.9 |

|

Fuel Oil |

0.23 |

0.19 |

0.22 |

0.03 |

15.8 |

|

Lubricants |

0.10 |

0.09 |

0.10 |

0.01 |

11.1 |

|

LPG |

0.50 |

0.52 |

0.51 |

(0.01) |

(1.9) |

|

Other |

0.35 |

0.41 |

0.41 |

|

|

|

|

25.00 |

23.87 |

22.72 |

(1.15) |

(4.8) |

Wholesale and other sales

Wholesale sales in Italy (8.37 mmtonnes) declined by approximately 253 ktonnes, down 2.9%, mainly due to lower sales of bunkering and bitumen reflecting a decline in demand, mostly completely offset by higher volumes sold of fuel oil and minor products. Average market share in 2013 was 28.8% (29.5% in 2012).

Supplies of feedstock to the petrochemical industry (1.32 mmtonnes) slightly increased from 2012 (up 62 ktonnes) due to higher feedstock supplies.

Wholesale sales in the Rest of Europe of approximately 4.23 mmtonnes increased by 6.8% from 2012 due to increased sales in Slovenia and France. Sales declined in Austria.

Other sales (19.45 mmtonnes) decreased by 3.75 mmtonnes, or 16.2%, mainly due to lower sales to other oil companies.

As concerns the development of bitumen, in 2013 the activities mainly referred to the production of bitumen that are suitable for the production of waterproof membranes. This products will allow the company to enlarge its presence on premium markets.

As to modified bitumen, the feasibility studies for the realization of a plant for the production of bitumen sheet-shaped (RIGEBIT), environmental friendly and with good commercial perspectives were concluded.

As far as lubricants are concerned, in 2013 Eni qualified three oils for gasoline engines and four oil for gasoil engines with high performances.

In the production of industrial lubricants Eni continued the cooperation with GE in particular on two lubricants for high-performance turbines with relevant energy saving characteristics.