Natural gas

Supply

The supply of natural gas is a free activity where prices are determined by free negotiations of demand and supply involving natural gas resellers and producers.

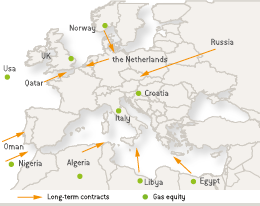

In order to secure mid and long-term access to gas availability, Eni has signed a number of long-term gas supply contracts with key producing countries that supply the European gas markets. These contracts have been ensuring approximately 80 bcm of gas availability from 2010 (including the Eni Gas & Power nv/sa portfolio of supplies and excluding Eni’s other subsidiaries and affiliates) with a residual life of approximately 14 years and a pricing mechanism that indexed to the cost of gas to the price of crude oil and its derivatives (gasoil, fuel oil, etc.).

Eni could also leverage on the availability of natural gas deriving from equity production, the access to all phases of the LNG chain (liquefaction, shipping and regasification) and to other gas infrastructures, anad by trading and risk management activity.

Eni’s long-term gas requirements are met by natural gas from a total of 18 Countries, where Eni also holds upstream activities and by access to European spot markets.

In 2013, Eni’s consolidated subsidiaries supplied 93.17 bcm of natural gas, representing a decrease of 2.15 bcm, or 2.3% from 2012. Gas volumes supplied outside Italy (78.52 bcm from consolidated companies), imported in Italy or sold outside Italy, represented approximately 92% of total supplies, were substantially in line with 2012 (down 0.62 bcm or 0.8%) due to higher volumes purchased in Russia (up 9.76 bcm) and the Netherlands (up 1.09 bcm), completely offset by lower volumes purchased in particular in Algeria (down 5.14 bcm), Norway (down 2.97 bcm) and Libya (down 0.77 bcm).

Marketing in Italy and Europe

Eni operates in a liberalized market where energy customers are allowed to choose the supplier of gas and, according to their specific needs, to evaluate the quality of services and offers. Overall, Eni supplies approximately 2,600 clients including large businesses, power generation utilities, wholesalers and distributors of natural gas for automotive use. Residential users are about 8 million and include households, professionals, small and medium sized enterprises, and public bodies located all over Italy, and approximately 2 million customers in European Countries. In a context characterized by a six percentage points structural drop of demand in the Italian market (down by 1% in the European Union) with the Eni’s expectation for 2017 of approximately 490 bmc, in line with 2013, lower than the projection of about 600 bmc developed in 2008, Eni intends to recover profitability in gas sales, renegotiating the cost position in order to reach price alignment with the new market conditions, developing an innovative supply addressed to large segment and growing in retail segment leveraging on service quality and dual offer expansion.

|

Sales and market shares on the Italian gas market |

(bcm) |

2012 |

2013 |

|

||||

|

|

|

Volumes sold |

Market share (%) |

Volumes sold |

Market share (%) |

% Ch. 2013 |

||

|

||||||||

|

Italy to third parties |

|

28.35 |

37.8 |

29.93 |

42.7 |

5.6 |

||

|

Wholesalers |

|

4.65 |

|

4.58 |

|

(1.5) |

||

|

Italian gas exchange and spot markets |

|

7.52 |

|

10.68 |

|

42.0 |

||

|

Industries |

|

6.93 |

|

6.07 |

|

(12.4) |

||

|

Medium-sized enterprises and services |

|

0.81 |

|

1.12 |

|

38.3 |

||

|

Power generation |

|

2.55 |

|

2.11 |

|

(17.3) |

||

|

Residential |

|

5.89 |

|

5.37 |

|

(8.8) |

||

|

Own consumption |

|

6.43 |

|

5.93 |

|

(7.8) |

||

|

TOTAL SALES IN ITALY |

|

34.78 |

46.4 |

35.86 |

51.2 |

3.1 |

||

|

Gas demand (a) |

|

74.91 |

|

70.10 |

|

(6.4) |

||

|

Gas sales by market |

(bcm) |

2009 |

2010 |

2011 |

2012 |

2013 |

|

|

|

|

|

|

|

|

|

ITALY |

|

40.04 |

34.29 |

34.68 |

34.78 |

35.86 |

|

Wholesalers |

|

5.92 |

4.84 |

5.16 |

4.65 |

4.58 |

|

Gas release |

|

1.30 |

0.68 |

|

|

|

|

Italian gas exchange and spot markets |

|

2.37 |

4.65 |

5.24 |

7.52 |

10.68 |

|

Industries |

|

7.58 |

6.41 |

7.21 |

6.93 |

6.07 |

|

Medium-sized enterprises and services |

|

1.08 |

1.09 |

0.88 |

0.81 |

1.12 |

|

Power generation |

|

9.68 |

4.04 |

4.31 |

2.55 |

2.11 |

|

Residential |

|

6.30 |

6.39 |

5.67 |

5.89 |

5.37 |

|

Own consumption |

|

5.81 |

6.19 |

6.21 |

6.43 |

5.93 |

|

INTERNATIONAL SALES |

|

63.68 |

62.77 |

62.08 |

60.54 |

57.31 |

|

Rest of Europe |

|

55.45 |

54.52 |

52.98 |

51.02 |

47.35 |

|

Importers in Italy |

|

10.48 |

8.44 |

3.24 |

2.73 |

4.67 |

|

European markets |

|

44.97 |

46.08 |

49.74 |

48.29 |

42.68 |

|

Iberian Peninsula |

|

6.81 |

7.11 |

7.48 |

6.29 |

4.90 |

|

Germany/Austria |

|

5.36 |

5.67 |

6.47 |

7.78 |

8.31 |

|

Benelux |

|

15.72 |

15.64 |

13.84 |

10.31 |

8.68 |

|

Hungary |

|

2.58 |

2.36 |

2.24 |

2.02 |

1.84 |

|

UK/Northern Europe |

|

4.31 |

4.45 |

4.21 |

4.75 |

3.51 |

|

Turkey |

|

4.79 |

3.95 |

6.86 |

7.22 |

6.73 |

|

France |

|

4.91 |

6.09 |

7.01 |

8.36 |

7.73 |

|

Other |

|

0.49 |

0.81 |

1.63 |

1.56 |

0.98 |

|

Extra European markets |

|

2.06 |

2.60 |

6.24 |

6.79 |

7.35 |

|

E&P in Europe and in the Gulf of Mexico |

|

6.17 |

5.65 |

2.86 |

2.73 |

2.61 |

|

WORLDWIDE GAS SALES |

|

103.72 |

97.06 |

96.76 |

95.32 |

93.17 |

A review of Eni’s presence in key European markets is presented below:

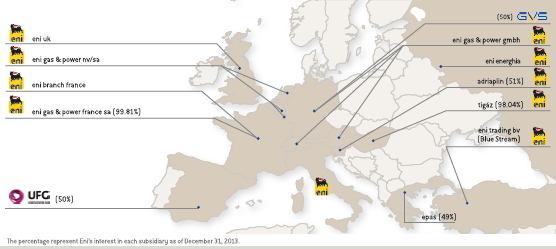

Benelux

Through a direct presence and the integration with its affiliate Distrigas, Eni holds a key position in the Benelux Countries (Belgium, the Netherlands and Luxembourg), in particular in Belgium, which are a strategic hub of the continental gas spot market in Western Europe, thanks to their central position and high level of interconnectivity with the gas transit networks of Central and Northern Europe. In 2013, sales in Benelux were mainly directed to industrial companies, wholesalers and power generation and amounted to 8.68 bcm, down by 1.63 bcm, or 15.8%, due to declining gas demand and rising competitive pressure in particular in the wholesalers segment.

Eni launched its brand in retail gas and power market in Belgium. The Eni brand substituted the local operators ones acquired in the past few years with the aim of becoming one of the major retail operators in France and Belgium while consolidating its leadership on the Belgian business market.

France

Eni sells natural gas to industrial clients, wholesalers and power generation as well as to the retail and middle market segments. Eni is present in the French market through its direct commercial activities and through its subsidiary Eni Gas & Power France sa. In 2013, sales in France amounted to 7.73 bcm (8.36 bcm in 2012), a decrease of 0.63 bcm, or 7.5%, from 2012.

In 2012, Eni launched its brand in the gas retail market in France, with the aim of becoming one of the major retail operators in France. In the next four-year period, Eni intends to increase sales in the Country into retail segment.

Germany/Austria

Eni is present in the German natural gas market through its associate GVS (Gasversorgung Süddeutschland GmbH - Eni 50%) which sold approximately 5.24 bcm in 2013 (2.62 bcm being Eni’s share), and through a direct marketing structure which sold in 2013 approximately 5.44 bcm in Germany and 0.25 bcm in Austria. In 2013, sales in Germany/Austria market amounted to 8.31 bcm, an increase of 0.53 bcm, or 6.8%, from a year ago.

Spain

Eni operates in the Spanish gas market through a direct marketing structure that markets its portfolio of LNG and the joint venture Unión Fenosa Gas (UFG) (Eni’s interest 50%) which mainly supplies natural gas to industrial clients, wholesalers and power generation utilities. In 2013, UFG gas sales in Europe amounted to 4.58 bcm (2.29 bcm Eni’s share). UFG holds an 80% interest in the Damietta liquefaction plant, on the Egyptian coast (see below), and a 7.36% interest in a liquefaction plant in Oman. In addition, it holds interests in the Sagunto (Valencia) and El Ferrol (Galicia) re-gasification plants (42.5% and 18.9%, respectively). In 2013, Eni sales in Spain amounted to 4.90 bcm.

Turkey

Eni sells gas supplied from Russia and transported via the Blue Stream pipeline. In 2013, sales amounted to 6.73 bcm, a decrease of 0.49 bcm, or 6.8% from 2012.

UK/Northern Europe

Eni through its subsidiary North Sea Gas & Power (Eni UK Ltd) markets in the UK the equity gas produced at Eni’s fields in the North Sea and operates in the main continental natural gas hubs (NBP, Zeebrugge, TTF). In 2013, sales amounted to 3.51 bcm, a decrease of 26.1% from a year ago.