Risk Management

Eni has developed and adopted a model for Integrated Risk Management (IRM) that targets to achieve an organic and comprehensive view of the Company main risks1, greater consistency among internally-developed methodologies and tools to manage risks and a strengthening of the organization awareness, at any level, that suitable risk evaluation and mitigation may influence the delivery of Corporate targets and value.

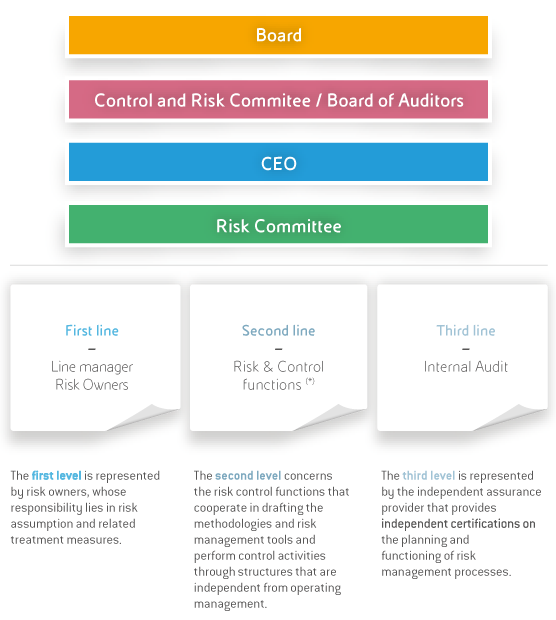

Integrated Risk Management Model

The IRM has been defined and updated consistently with international principles and best practices. It is an integral part of the Internal Control and Risk Management System (see chapter "Governance") and is structured on three control levels.

(*) Including Integrated Risk Management department.

Risk governance attributes a central role to the Board of Directors. The Board, with the support of the Control and Risk Committee outlines the guidelines for risk management, so as to ensure that the main corporate risks are properly identified and adequately assessed, managed and monitored.

In addition, the Eni Board of Directors, in fulfilling its responsibilities and its role of direction and with the support of the Control and Risk Committee, defines the degree of compatibility of these risks with the company management consistent with its strategic targets. For this purpose, Eni’s CEO, through the process of integrated risk management, presents at least every six months Eni’s a review of the main risks to the Board of Directors. The analysis is based on the scope of the work and risks specific of each business area and processes aiming at defining an integrated risk management policy; the CEO also ensures the evolution of the IRM process consistently with business dynamics and the regulatory environment.

Furthermore, the Risk Committee, chaired by the CEO, holds the role of consulting body for the latter with regards to major risks. For this purpose, the Risk Committee evaluates and expresses opinions, at the instance of CEO, related to the main results of the integrated risk management process.

Our process of integrated risk management

The IRM model is implemented through a process of integrated management which is both continuous and dynamic, leveraging on the risk management systems already adopted by each business unit and corporate processes, promoting harmonization with methodologies and specific tools of the IRM.

The commencement of the risk assessment process includes the definition of its scope, basing on the guidelines defined by the Board of Directors, i.e. the identification of the organizational functions/units and, when necessary, the processes of Eni and its subsidiaries, which might significantly impact the achievement of corporate objectives, and the relevant management to be involved in the IRM process.

In 2013, two assessment sessions were performed: the interim top risk assessment performed in the first half of the year, relating to the update and in-depth identification, evaluation and treatment of top risks resulted by the 2012 risk assessment and the yearly risk assessment performed in the second half of the year involving 13 subsidiaries.

Based on the major risks identified through the above mentioned assessments, the strategic guidelines and treatment measures for their mitigation/management were identified and submitted to Eni’s management, consistently with the evolution of internal/external context and of the Company’s strategy.

The first monitoring assessment of Eni’s top risks identified in 2012 was also performed. The monitoring of main risks and the relevant treatment plans through appropriate indicators (Key Risk Indicator, Key Control Indicator, Key Performance Indicator) allow to identify improvement areas in the management of major risks, analyze their evolution as well as the progress in implementation of further treatment measures decided by the management (also related to the update and development and risk management models) and to timely identify potential new risks.

The assessment and monitoring results were submitted to the Risk Committee and to the management and control bodies according to the procedure provided by the Management System Guidelines MSG IRM (interim IRM reporting and annual IRM reporting).

The following table summarizes Eni’s main risks in relation to corporate targets, except for scenario risk, linked to operating performance variability related to fluctuations in crude oil prices, natural gas and oil products prices. For further details on these risks, as well as minors uncertainty factors, see the section “Risk factors and uncertainties”.

(1) Potential events that can affect Eni’s activities and whose occurrence could hamper the achievement of the main corporate objectives.

|

Targets, risks and treatment measures |

||||

|

|

|

|

|

|

|

Company targets |

Risk category |

Main risk events |

Rif. Risk factors and uncertainties section |

Treatment measures |

|

Company profitability |

Country risk |

Political and social instability in Countries of operations that might lead to unrest, strikes, act of violence, sabotage, attacks with production losses and interruptions as well as interruptions in gas supplies via pipe. |

Balancing geographic presence through progressive expansion into areas with lower socio-political risks, keeping efficient and long-lasting relationships with producing Countries and local stakeholders even through sustainable development projects; plans of security emergencies management and prevention. |

|

|

Company profitability |

Country risk |

Difficulties in finding adequate resources in Countries where the use of local suppliers is mandatory (Local Content) with negative effects on the oil&gas time-to-market of projects. |

Risks associated with the explorationand production of oil and natural gas |

Definition, in the project planning phase, of contractual and procurement strategies, Early Local Content Plan and adequate contingency plan, continuing commitment with relevant authorities aimed at agreeing upon the Local Content requirements, local suppliers selection and technical evaluation, training of local human resources. |

|

Company profitability |

Strategic risk |

Poor contractors (and subcontractors) performance, in particular in large EPC projects, with impact on projects profitability. |

Risks associated with the explorationand production of oil and natural gas |

Specific contractual strategies (long-term commitment, incentives/penalties clauses), direct management of Work Packages and interfaces between contractors, in-sourcing and direct control of the critical phases of the project, continuing and active monitoring of contractors, performance of technical audits and quality plan implementation. |

|

Company profitability |

Strategic risk |

Complex finalization of oil and commercial negotiations due to institutional and regulatory changes in the Countries of operations. |

Risks associated with the explorationand production of oil and natural gas |

Monitoring of external trends and uncertainties that might a effect the outcome of commercial negotiations (elections, economic crisis, developments in the political framework, etc.). Maintaining stable relationship with State-owned Companies and local Partner, benchmarking with contractual clauses obtained in other projects and contexts. |

|

Company profitability |

Strategic risk |

Weak fundamentals European gas sector and lack of alignment of the supply cost of the long term contracts to selling benchmarks, volumes risk impacting on sales profitability. |

Renegotiation of gas supply contracts in terms of pricing and volumes. Evaluate the option to recur to international arbitration proceedings in case of unsuccessful renegotiations. |

|

|

Company profitability |

Financial risks |

Commercial credit risk |

Risks associated with the explorationand production of oil and natural gas |

Preventive evaluation of clients ability to meet financial commitments. Internal structures and rules dedicated to credit risks, specific initiatives/projects for the management of most critical situations as well as resort to factoring. |

|

Company profitability |

Operating risks and related HSE risks |

Blow-out risks and other relevant accidents at extractive infrastructures, refineries and petrochemical plants in the transportation of hidrocarbons by sea and land (i.e fires/ explosions, etc.) affecting results, cash flow, reputation and strategies. |

"Real time monitoring" of wells drilling phases, increase of operatorship, specific technological development and emergency management plans. Security management system, certifications achievement, implementation of an internal regulation on HSEQ issues; periodic plants audits. Continuing management and monitoring of shipping and third parties operations. |

|

|

Company profitability |

Operating risks and related HSE risks |

Environmental proceedings and evolution in the HSE legislation triggering contingent liabilities, operating costs and extra-costs relating to remediation activities. |

Control on sites remediation activities and monitoring of activity effectiveness, development of technologies for environmental remediation, management of issues related to authorization process of remediation activities and territory development with Public Administration. Existence of an Integrated System of HSE Management, alignment of the company regulation to new legislation, training and technical audit performed by HSE units. |

|

|

Leverage reduction |

Strategic risk |

Downgrading of Eni rating in connection with a potential downgrade of the sovereign rating of Italy. |

Targeting a well balanced financial structure maintaining a gross cash reserve, commeasured to business risks, debt repayment as well as adequate leverage level, definition by the Board of Directors of specific thresholds for the main financial risks, continuing dialogue with investors and rating companies. |

|

|

Employees safety and asset integrity |

Country risk |

Security risk in geographic areas of strategic interest for the company, with production losses and interruptions. |

Continuing control performed by dedicated organizational structures, security management system and security assessment completion on all the sites, training activities on security issues. |

|

|

Local development and stakeholder relationship |

Strategic risk |

Negative perception by a number of local and international stakeholders as to the activities of the oil & gas industry. |

Development of a communication model endorsing Eni's commitment on the sustainable development, achievement of ISO 14001 and QHSAS 18001 certifi cations by all the E&P subsidiaries with relevant HSE risks, continuing commitment for the reduction environmental footprint of industrial operations and granting access to energy in underdeveloped Countries. |

|