Governance

Integrity and transparency are the principles that have inspired Eni in the formulation of its Corporate Governance system1 and are the pillars of the Company’s business model. The Governance system, supplementing Eni’s business strategy, is designed to sustain the relationship of trust between Eni and its stakeholders and to help achieve business results, creating sustainable long-term value.

Eni, as Italy’s top company by capitalisation, is committed to building a Corporate Governance system inspired by excellence in a transparent relationship with the market. For this reason, Eni places great emphasis on communication with its stakeholders, taking account of their needs and maintaining an ongoing commitment to helping shareholders effectively exercise their rights, developing an open dialogue that fosters mutual understanding. In this context, in 2013 the Chairman of the Board of Directors of Eni held a series of meetings with institutional investors and the major proxy advisors in Europe and the United States in order to provide them with a complete understanding of Eni’s Corporate Governance system and how it relates to the various regulatory models.

Eni’s Corporate Governance structure

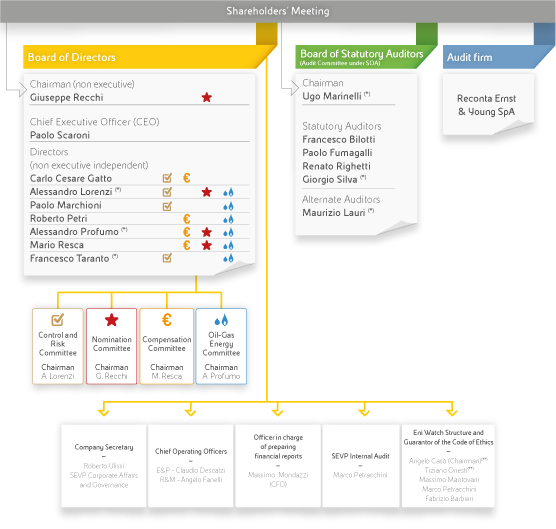

The Corporate Governance arrangements of Eni are structured along the lines of the traditional model, which, without prejudice to the responsibilities of the Shareholders’ Meeting, assigns corporate management duties to the Board of Directors, monitoring functions to the Board of Statutory Auditors and the auditing of the financial statements to the audit firm.

The Board of Directors and the Board of Statutory Auditors of Eni, as well as their respective Chairmen, are appointed by the Shareholders’ Meeting using a slate voting mechanism. Three directors and two statutory auditors, including the Chairman of the Board of Statutory Auditors, are appointed by non-controlling shareholders, thereby ensuring that the number of representatives of non-controlling shareholders exceeds the minimum established by law. In addition, the number of independent Directors indicated in Eni’s By-laws exceeds that required by law. In fact, the number of independent Directors currently serving (seven2 out of nine Directors, of whom eight are non-executive Directors) is above the minimum set out in the By-laws and in the Corporate Governance rules, as well as the average number of such directors for Italian listed companies in general. The Board’s structure is also balanced in relation to the professional qualifications and experience of the Directors, gained in companies operating primarily in the industrial, banking or financial sectors. Starting from the next election in 2014, the Board of Directors and Board of Statutory Auditors will be assured a balanced gender representation, as provided for By-Law and the Company’s By-laws3.

The Board of Directors has appointed a Chief Executive Officer (“CEO”) and granted the Chairman powers, provided for in the Eni By-laws, to identify and promote integrated projects and international agreements of strategic importance.

The Board of Directors has established four internal committees with consulting and advisory functions: the Control and Risk Committee4, the Compensation Committe5, the Nomination Committee and the Oil-Gas Energy Committee, which report to the Board at each meeting on the most significant issues addressed.

The following chart provides a graphical representation of the Company’s Corporate Governance structure:

Decision-making processes

The Board of Directors has appointed a Chief Executive Officer to manage the Company, while retaining responsability over strategic, operational and organizational matters, particularly in the fields of governance, sustainability6, internal control and risk management.

The Directors are made knowledgeable and informed about the company’s matters in order to make effective decision-making processes. The Board, thanks to its diversified range of expertise and competences, has the capabilities to perform the in-depth review that is required by the complexity and reach of the Company’s business. The newly-appointed Boards underwent an induction7 program and other training initiatives, including visits to a number of key operating sites, such as in Venezuela in 2013. The Directors are also promptly and fully informed about matters on the Board’s agenda.

To achieve this, specific procedures have been established for setting the deadline by which documentation must be made available prior to Board meetings, and the Chairman ensures that each Director is able to contribute effectively to Board discussions.

Before the Board’s approval of the Company’s strategic guidelines, an annual Strategy Day is organised to evaluate and discuss major issues. The Oil-Gas Energy Committee assists the Board in preparing for the event.

The Board’s training and informational activities over the past year have focused on the Board’s duties and responsibilities in the areas of control and risk. The Company also decided to take part in the Global Compact LEAD Board Programme Pilot Phase8, which is devoted to training Directors on sustainability issues, as Eni actively contributed to the development of the program.

The Board’s most important duties include appointing key management and control personnel, including the Chief Operating Officers, the Officer in charge of preparing financial reports (Financial Reporting Officer) and the Internal Audit Senior Executive Vice President. The Board is supported by the Nomination Committee in performing these duties.

Remuneration policy

Eni’s remuneration policy for its Directors and top management is established in accordance with the recommendations of the Corporate Governance Code and best practices in the field. The Policy seeks to retain with high-level professionals and skilled managers and to align the interests of management with the priority objective of creating value for shareholders over the medium/long-term.

Pay-mix

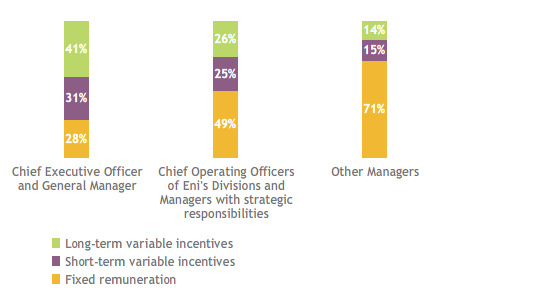

For this purpose, the remuneration of Eni’s top management is established on the basis of the position and the responsibilities assigned, with due consideration given to market benchmarks for similar positions in companies similar to Eni in dimension and complexity. Remuneration is composed of a balanced mix of fixed and variable elements.

Under Eni remuneration policy, considerable importance is given to the variable component, which is linked to the achievement of preset performance and financial targets, business development and operational objectives, also considering the long-term sustainability of the results, in line with the Company’s Strategic Plan.

The variable remuneration of Eni’s executive officers having a greater influence on the business performance is characterised by a significant percentage of long-term incentive components, to be paid at the end of a three-year vesting period to reflect the long-term nature of the business.

With regard to sustainability issues, the CEO objectives set for the incentives which will be paid in 2014, focused also on maintaining Eni’s presence in the main sustainability indexes, as well as the development of the “Integrity Culture” program.

The objectives of the Chief Operating Officers of Eni Divisions and other Managers with strategic responsibilities are assigned on the base of the role and the responsibilities assigned also in terms of health and safety, environmental protection, relations with stakeholders. The remuneration policy is described in the first section of the “Remuneration Report”, available on the Company’s website (www.eni.com) and is presented, on an annual basis, for an advisory vote at the Shareholders Meeting9.

The internal control and risk management system

Eni has adopted an integrated and comprehensive internal control and risk management system based on reporting tools and flows that, involving all Eni personnel, reach all the way up to the Company’s top management. The members of the Board, as well as the members of the other corporate bodies and all Eni personnel, are required to comply with Eni’s Code of Ethics (as part of the Company’s Model 231), which sets out the rules of conduct for the fair and proper management of the Company’s business. In March 2013, Eni adopted a regulatory instrument for the integrated governance of the internal control and risk management system, the guidelines of which, approved by the Board, set out the duties, responsibilities and procedures for coordinating between the primary system actors. For detailed information on Eni’s risk management system, see the section “Risk management”.

An integral part of the Eni internal control system is the internal control system for financial reporting, the objective of which is to provide reasonable certainty of the reliability of financial reporting and the ability of the financial report preparation process to generate such reporting in compliance with generally accepted international accounting standards. Eni’s CEO and Chief Financial Officer (CFO) are responsible for planning, establishing and maintaining the internal control system for financial reporting. The CFO also serves as the officer in charge of preparing financial reports (FRO), who must satisfy specific professional requirements set out in the Eni By-laws.

(1) For further information on Eni’s Corporate Governance system, refer to Eni’s Corporate Governance Report, which is published on the Company’s website in the Governance section.

(2) Reference is made to the independence requirement under both the law, to which Eni’s By-laws refers, and the recommendations of the Italian Corporate Governance Code.

(3) More specifically, the less-represented gender must receive at least one-fifth of the positions on each board in the first election and one-third of the positions in the next two elections. The law establishes that this composition shall apply to the corporate boards of unlisted Italian subsidiaries, but the Board of Directors of Eni has, since the 2012 elections, required that at least one-third of the members be women with regard to the appointments that Eni may make as shareholder.

(4) As to the composition of the Control and Risk Committee, Eni requires that at least two of its members possess adequate experience in accounting, financial or risk management matters, strengthening the Corporate Governance Code provisions, which recommends that one member have such experience.

(5) The Compensation Committee rules require that at least one member have an adequate knowledge of and experience in financial matters or compensation policies, to be evaluated by the Board of Directors at the time of appointment.

(6) More specifically, the Board has retained the exclusive power to set sustainability policies, the results of which are comprehensively reported together with financial and performance information in the Annual Report, as well as to examine and approve the sustainability reporting not covered in the integrated reporting system.

(7) Following the program commenced in 2012, Eni conducted a training program in 2013 for new members of the boards of directors of its Italian subsidiaries, gradually extending it to its foreign subsidiaries and investees, with a special emphasis on business integrity.

(8) Eni is a member of the UN Global Compact LEAD Group.

(9) More specifically, Eni confirmed the high level of votes in favour registered in 2013, as well as in 2012, in the field of its remuneration policy. In fact, out of 61.08% of the share capital represented at the meeting (with a significant increase in the Assembly’s participation as compared to 56.4% registered in 2012), 96.2% of the shares present voted in favour, registering an increase of approximately 3.6% compared to 2012.