Our strategy

In 2013 our upstream activity was negatively impacted by the increased political instability in certain countries of operations. Our mid-downstream businesses recorded operating losses as they were hit by structural headwinds in the competitive context and continuing weak demand, against the backdrop of the European downturn, particularly in Italy.

In order to tackle with a deteriorated trading environment, management has planned a number of actions that are intended to help the Company to achieve strong performances in each of its business segment against prudent, cautious and conservative assumptions about the external context whereby we do not anticipate any meaningful improvement in market conditions and have projected flat production profiles in the Company’s main countries at risk of political instability (i.e. Libya, Nigeria and Algeria).

Eni’s strategy confirms the priorities of profitable growth in the upstream, turning around the mid-downstream businesses, recovering profitability at Saipem and monetizing non-core exploration assets. Assuming a Brent price of $90 a barrel for the full year 2017, our projected operating cash flows (up 40% in the two years period 2014-2015 and 55% in 2016-2017) will provide enough resources to maintain the leverage below the ceiling of 0.30, to finance the planned capital expenditure (€54 billion) and to ensure a progressive increase in the cash returned to shareholders also through the flexible tool of the buyback program.

Production growth

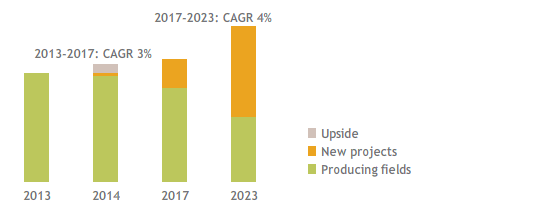

Production growth (kboe/d)

Our growth strategy in the Exploration & Production Division has been reinvigorated by the extraordinary exploration successes made in the latest years which have build upon an already solid platform of large, conventional producing assets with an efficient cost position. The exploration successes has proven to be an efficient and effective way to increase the resource base, a driver of organic production growth and portfolio diversification also providing a boost to cash generation by early monetization of part of the discovered volumes.

In the next four-years Eni targets a robust cash generation coupled with production growth and a rebalanced risk profile of our portfolio. We also plan to increase our resource base leveraging on our leading exploration activity where we boast an impressive track-record in discovering new resources. All these industrial targets are planned to be achieved through a capital expenditure plan 5% lower than the previous one.

Under Eni’s price scenario, management expects to increase operating cash flow by 4% on average in the next four years plan. This coupled with a continuing focus on capital discipline will drive the achievement of a self-financing ratio1 of 140% on average. The strong cash generation will be the result of organic production growth, the quality of our portfolio which is largely made-up of conventional asset, our phased approach in giant projects, reduced time-to-market and production optimizations.

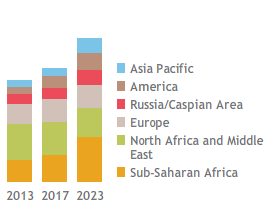

Average production growth is expected at a rate of 3% in the 2014-2017 period. Growth will be fuelled by new production additions in Eni’s core areas (Sub-Saharan Africa, Venezuela, the Barents Sea and Kazakhstan) leveraging on Eni’s vast knowledge of reservoirs and geological basins, technical and producing synergies, as well as established partnerships with producing Countries.

Exploration

Exploration

New fields start-ups of 26 major projects, most operated and coming from our exploration activities (including the Goliat in the Barents Sea, the Block 15/06 in the West Hub located in Angola, gas and heavy oil assets in Venezuela, OCTP oil development in Ghana and Jangkrik in Indonesia), will add more than 500 kboe/d of production in 2017 to support our growth and replace mature field decline.

Since 2008 we discovered approximately 9.5 bboe of resources, largely conventional and at competitive costs, which accounted more than double of our production in the period. Eni confirms its commitment to the exploration strategy as the pillar of the long-term sustainable growth.

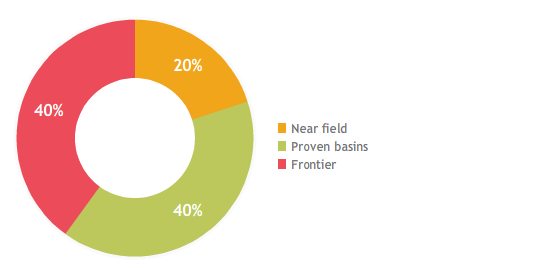

We plan to execute finding projects in high risk-high reward area and near field activities to target the discovery of 3.2 bboe of new resources at a unit cost of approximately $2.2 per barrel. These discoveries will be developed to ensure high-margin organic growth. Another option is their monetization in advance of development activities by diluting Eni’s interest at an early stage thus reducing the execution and financial risk as it was the case with the Mozambique deal.

The achievement of the planned growth targets will be underpinned by a continuing focus on risk mitigation. The main drivers are the diversification of the country presence, the reduction of the time-to-market, the in-source of critical engineering and project management activities, the retention of a large number of operated projects and the contribution to local development (promoting access to energy, education and training and the improvement of health and safety conditions). In particular, Eni reaffirms its commitment to promote access to energy in Sub-Saharan Africa (including Mozambique, Nigeria, Ghana and Congo) involving the construction of power plants, natural gas transportation and distribution facilities as well as isolated systems (off-grid) to provide electricity to remote communities.

Notwithstanding Eni’s commitment to maintain long-term relations with host countries, disruptions following socio-political unrest represent an unpredictable factor and a source of possible risks to an upstream company. Following disruptions in Libya, Nigeria and Algeria with a production loss of approximately 110 kboe/d for the full year 2013, the contribution of these important countries to Eni’s production growth profile up to 2015 has been prudently assumed to be marginal.

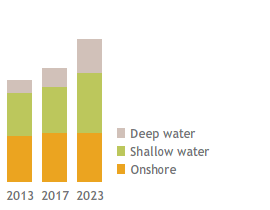

Production diversification

Production diversification (kboe/d)

The execution capabilities of contractors in the EPC contractual scheme are a major source of risk to the profitability of development projects. Eni has adopted strong organizational options to ensure effective control on the most important project activities. The Company has elected to execute most of the engineering phase in-house through a reinforced organizational structure. We directly coordinate all the construction phases and deploy our own people to manage hook-up and commissioning. Following this approach management believes that all projects currently being executed which will be started-up in the next four years are as a whole on time and on budget.

Operational risk relating to drilling activities will be managed by applying Eni’s rigorous procedures throughout the engineering and execution stages. The main drivers of this will be the adoption of our field-tested proprietary drilling technologies, our excellent skills and know-how and increased control of operations. The excellence in our drilling activities allowed us to achieve zero blow-outs for the tenth consecutive year. The planning of emergency responses and quick remediation in case of accidents, oil spills or gas leaks is as rigorous as our operations.

Targets on environmental impact include the reduction in GHG emission rates and the depletion of natural resources by means of flaring down policies and rehabilitation projects of production water.

In particular projects of water re-injection in Egypt, Nigeria, Tunisia, Iraq, Angola, Ghana, Norway and Congo are estimated to allow a recovery factor up to 70% of the total water produced in 2017 from a rate of water re-injected of 55% in 2013.

Management expects that continuing development proprietary technologies to be applied in complex environment and competence build-up will drive production growth and value creation as well as increase the safety in our operations. Eni estimates to spend €500 million in R&D (on an overall Eni’s expenditure of €1.2 billion) over the 2014-2017 plan period.

In the Gas & Power Division, we expect continuing weak conditions in the trading environment due to strong competition, oversupply in Europe and the strengthening of the role of the continental hubs to trade spot gas. In this scenario, management believes that the key factors are the ability to oversee trade hubs, to enhance the flexibility of our portfolio and to adapt our contracts and assets to the current tough market environment. Management reaffirms its commitment in restoring profitability and preserving cash generation leveraging on a robust turnaround plan which provides for: (i) restructuring our supply contracts in order to reach price alignment with the new market conditions and to minimize the impact of take-or-pay risks on future cash flows through a new round of negotiations or arbitrations; (ii) focus on high-value added businesses, such as LNG, through integration with upstream segment and increasing sales in premium markets, on trading activities, through the enhancement of the physical and contractual assets in portfolio, as well as the development of our retail customer base; (iii) the re-engineering of B2B business with innovative products for our customers and efficiency actions and integration with the skills of the trading unit; (iv) process reengineering and cost cutting in our operations.

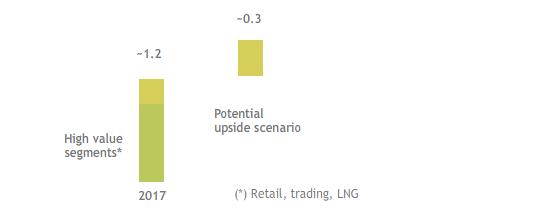

Proforma EBITDA adjusted

Proforma EBITDA adjusted (€ bln)

Management believes that these turnaround drivers will help the Company to restore profitability by 2015 and generate approximately €1,2 billion of EBITDA pro-forma adjusted in 2017.

In R&D, Eni aims to assess the impact of advanced LNG technologies on the increase of natural gas consumption in the industrial and business segment and to enhance technological developments related to the energy efficiencies in the mid-market and retail (cogeneration, energy storage, smart metering and integration with renewable energy sources).

In the Refining & Marketing Division a number of additional actions compared to the previous strategic plan have been launched in order to face the further worsening of the trading environment with a refinery margin which fell to unprecedented levels, down to less than one dollar per barrel in the last quarter of the year.

In the refining activity, Eni will deploy the following initiatives: (i) the reorganization and optimization of refinery plants through rationalizations and reconversion of processes (biorefinery in Venice and restructuring of Gela) resulting in a 22% cut of existing refining capacity in the four-year plan; (ii) higher flexibility, process integration and efficiency to better face market scenario; (iii) the improvement in operating efficiency and energy saving projects.

Building on these initiatives, in the 2014-2017 four-year period Eni intends to increase plants’ efficiency and to reach energy savings for a total of 114 ktoe/y.

Water reuse projects at Gela and Sannazzaro plants are expected to lead to savings of water use of 5 mmcm/y.

In marketing operations management intends to enhance the presence in the fuels market by: (i) gaining higher efficiency results (closing stations with low throughput), developing non-oil operations and LPG and methane distribution; (ii) retaining Eni’s position in the wholesale market also leveraging on opportunities deriving by the closing of third parties’ refinery; (iii) launching innovative activities, by means of new products (LNG in the automotive segment) and innovative services (smart mobility).

Building on these initiatives, in the 2014-2017 four-years period Eni expects to increase its adjusted EBIT under constant scenario assumptions (base 2013) by €0.7 billion by 2017.

Eni’s initiatives in the Research and Development field intend to prove the T-Sand and Zero-Waste technologies in the two-years period 2014-2015 and to define technological solutions to process second generation biomasses for the production of Biofuels at the Venice’s refinery.

Eni’s Chemical segment has been hindered by falling commodity demand and increasing competition mainly in its more commoditized lines of business and in those with low technologic content.

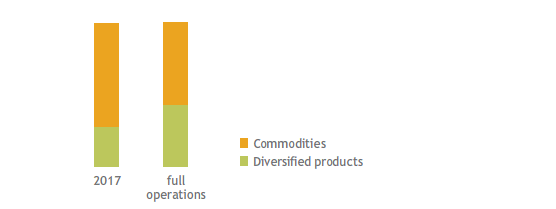

Against the backdrop of this scenario, the 2014-2017 strategic plan sets the stage for: (i) a more adequate and efficient cost position leveraging on the optimization/rationalization of Italian critical industrial sites, and higher integration, optimization and flexibility of production; (ii) the refocusing on premium productions, reducing the exposure to commodity chemicals, the selective development of a technological platform in the elastomers and styrenes, and the expansion of the specialties segment. Eni intends to grow the green chemistry business for the manufacture of eco-compatible chemical products and with high-growth demand rate; (iii) a greater internationalization of the business to serve customers even more global and markets characterized by high-growth demand rates, also through strategic alliances.

Versalis production mix

Versalis production mix

Energy efficiency programs planned in Porto Marghera and Porto Torres sites will allow energy savings of 44.5 ktoe/year.

In the four year plan, Eni expects to invest approximately €3.3 million to carry on activities agreed with the relevant Authorities and local people, in order to reconvert critical sites, safeguarding and developing employment and local economy.

In light of these initiatives, in the 2014-2017 plan, adjusted EBIT under constant scenario assumptions (base 2013) is expected to increase by €0.5 billion in 2017.

The Engineering & Construction segment faced a complex 2013 due to operating difficulties in certain projects in the Onshore and Offshore activities of the Engineering & Construction business unit. Saipem expects a recovery in profitability in 2014 and to gradually improve margins in the following years leveraging on the completion of low-margins contracts still present in the current portfolio, effective commercial discipline and investment activities recently completed. These actions will strengthen Saipem’s business model in strategic areas and markets.

As far as R&D is concerned, Saipem intends to focus on the development of technologies in the Engineering & Construction Offshore business unit for working in deep and ultra deep waters, subsea processing and for the installation of underwater pipes in extreme conditions.

In the onshore business, it will increase the competitiveness of proprietary technologies and know-how to better preserve environment and reduce ghg emissions. In the Offshore and Onshore drilling business units Saipem plans to develop methodologies and innovative technologies.

(1) Ratio of cash flow (net profit + amortization) and cost incurred (exploration and development investments + proved and unproved reserves purchases)