Gas & Power

In the Gas & Power Division, Eni expects to achieve an increase in cash generation and to restore profitability leveraging on:

- restructuring of our supply portfolio, in order to reach price alignment with the new market conditions and to minimize the impact of take-or-pay risks on future cash flows through a new round of negotiations or arbitrations;

- focus on high value added businesses, such as LNG, through integration with upstream segment and increasing sales in premium markets, particularly in Far East, on trading activities, through the enhancement of the physical and contractual assets in portfolio, as well as the development of our retail customer base;

- the re-engineering of B2B business by means of commercial offers of innovative products for our customers, efficiency actions and integration with the skills of trading unit;

- process re-engineering and cost cutting in our operations.

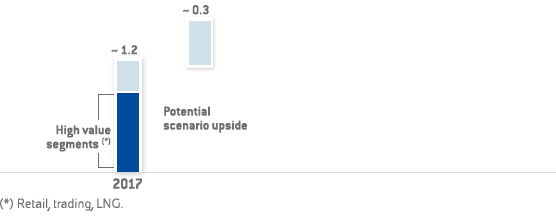

Management expects that these turnaround drivers will help the Company to restore profitability by 2015 and generate approximately €1.2 billion of adjusted proforma EBITDA in 2017.

Adjusted proforma EBITDA (€ billion)