Activities – Marketing

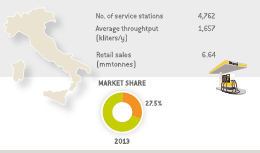

Retail Italy

Eni is a leader in the Italian retail market of refined products with a 27.5% market share, down by 3.7 percentage points from 2012 when sales volumes benefited of the effect of a promotional campaign made during the summer weekends (“riparti con eni”). In 2013, retail sales in Italy of 6.64 mmtonnes decreased by approximately 1.19 mmtonnes or 15.2% from 2012, driven by lower consumption of gasoil and gasoline, in particular at highway service stations reflecting the decline in freight transportation and high competitive pressure. Average gasoline and gasoil throughputs (1,657 kliters) decreased by approximately 318 kliters from 2012.

At December 31, 2013, Eni’s retail network in Italy consisted of 4,762 service stations, 18 stations less than at December 31, 2012 (4,780 service stations), resulting from the negative balance of the closing of service stations with low throughput (51 units), the release of one motorway concession, partially offset by the positive contribution of acquisitions/releases of lease concessions (34 units).

Premium fuels

In 2013 sales of premium fuels (fuels of the “Eni Blu+” line, featured with higher performance and lower environmental impact) were affected by the decline in domestic consumption as well as high price levels and registered a decline compared to the previous year. In particular, sales of Eni BluDiesel+ amounted to approximately 231 mmtonnes (approximately 278 mmliters) with a decline of approximately 61 ktonnes from 2012 and represented 5.3% of volumes of gasoil marketed by Eni’s retail network. At December 31, 2013, service stations marketing BluDiesel+ totaled 3,909 units (4,123 at year-end 2012) covering approximately 82% of Eni’s network. Retail sales of BluSuper+ amounted to approximately 30 ktonnes (approximately 41 mmliters), decreasing by 4 ktonnes from 2012, and covered 1.6% of gasoline sales on Eni’s retail network (broadly in line with previous year). As of December 31, 2013, service stations marketing BluSuper+ totaled 2,171 units (2,505 at year-end 2012), covering approximately 46% of Eni’s network. In 2013 Eni continued the development of innovative bio-fuels as well as proprietary additives and detergents that provide better gasoline and gasoil with a “keep clean” component.

Commercial initiatives

Within the initiatives aimed at favoring consumption in a negative economic scenario and creating a sounder customer relationship, Eni launched the following initiatives:

Comarketing

From the first months of 2013, Eni signed a number of agreements with its partners active in the sectors of large distribution, telecommunications and clothing, in order to give an immediate economic advantage to the customers in possession of Eni’s loyalty cards. For Eni, this means being able to give Italian customers more value in their daily purchases of large consumption goods and at the same time increase the contacts and incentivize the average throughput.

In order to support these activities, in 2013 Eni emitted 4 million of discount codes, 1.6 million of which were utilized, for the total of 40 million of litres sold.

Loyalty and payment cards

Eni’s fidelity and payment cards combine point accumulation program, related to purchase of fuel and non-oil products in Eni’s stations and in the stations of Eni’s commercial partners, with reloadable and credit card functions. By means of fidelity and payment cards, as well as cards previously emitted within “you&eni” program, customers can accelerate the point accumulation in Eni’s branded service stations and in about 30 million stores displaying the CartaSì or Mastercard brands.

The cards are available in four different versions:

- basic prepaid with one time ceiling of €1,000 and an annual expense ceiling of €2,500;

- prepaid with contract for an annual expense ceiling at €12,500;

- credit card;

- prepaid young, designed for young people between the ages of 14 and 23, with one time ceiling of €1,000 and an annual expense ceiling of €2,500.

As of January 31, 2014 approximately 1,100,000 of new cards were requested (95% of which were basic prepaid), 150,000 of which were activated with first recharge.

As of December 31, 2013, approximately 2.8 million customers effected at least one transaction within the program. The cards which were active on the monthly basis averaged 1.3 million. In 2013, volumes sold to customers accumulating points on their cards accounted for approximately 37% of all network throughputs.

In 2013, Eni launched two important initiatives, in order to support the new card emission and activation of their payment function:

- the promotion “2€ for every 20 litres”, lasted until October 31, 2013. Thanks to this special promotional offer, customers who refuel using you&eni or young&eni were entitled to a free fuel bonus of 2€ in extra you&eni points for every 20 litres purchased with the card, up to a daily maximum of €10 for every 100 litres;

- the promotion “Promo coi fiocchi” which offered you&eni and young&eni payment cards customers a bonus (in you&eni points) in free fuel after every refill of the certain amount.

Multicard Routex

The Routex Multicard is a service platform based on Fuel Card designed for business customers (transport professionals and car fleets managers). Its commercial offer includes fuel purchase without using cash, recurring invoicing, deferred payment, discount to fuel prices, reports on consumption and distances covered, possibility of services purchase related to the trip. This initiative aims at gaining loyalty from customers across Europe as the card can be used in Italy on all eni/Agip branded service stations and, in its international version, on the service stations of all members of the Routex consortium (Aral, BP, OMV and Statoil).

Electronic fuel coupons

In September 2013, Eni started to sell rechargeable fuel vouchers, designed especially for business customers.

Non-oil

Eni continued its engagement in enriching the offer of non-oil products and services in Eni’s service stations in Italy by developing the following franchised chains:

“enicafè&shop”, which is a chain of 659 coffee shops and stores, set up according innovative format through the transformation of the pre-existing shops and stores, where food as well as other products and services (such as wifi connection) are marketed;

“eni wash”, which is a format deployed at 280 stations areas, which provides for car washing with no-scratch brushes of latest generation. The offer “eni wash” allows to choose one of the three types of self-service wash with the same price in all Italy. The payment stations, new to Italian market, accept coins, banknotes, ATM and credit cards;

“enishop24”, which is a vending machine format deployed at 620 stations. It’s a self-service area with 2 o 3 vending machines where the customers can buy food, beverage products as well as personal care products.

In 2013, non-oil returns on the network, including lubricants margins, were €36.9 million.

Smart Mobility

In December 2013, Eni launched in Milan the initiative “Enjoy”, a car sharing free floating with the objective of developing products and services for sustainable mobility. This service is provided in partnership with major Italian players (Fiat, Trenitalia, Cartasì, allows the customers to pick up and release a car in any part of the covered area and represents a new and economic, sustainable and efficient alternative to owing car. The service is simple and completely online, the tariffs are all inclusive and competitive in comparison with competitors’. As part of the development strategy of “Enjoy”, the service well be extended to other major Italian cities and abroad. In addition, other innovative products and services related to mobility will be developed.

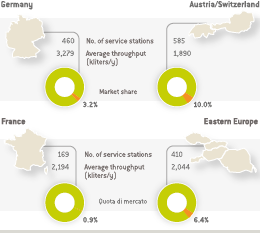

Retail Rest of Europe

Retail sales in the Rest of Europe of 3.05 mmtonnes registered a slight increase compared to 2012 (up by 0.3% or 10 ktonnes). Higher volumes marketed in Germany and Austria were almost completely offset by lower sales in the Czech Republic and Hungary. At December 31, 2013 Eni’s retail network in the Rest of Europe consisted of 1,624 service stations, with an increase of 20 units from December 31, 2013 (1,604 service stations). The network evolution was as follows: (i) the closing of 25 low throughput service stations mainly in France; (ii) the positive balance of acquisitions/releases of lease concessions (26 units) in particular in Germany and Austria; (iii) the purchase of 18 service stations, in particular in France and Germany; (iv) the opening of one new outlet. Average throughput (2,322 kliters) was in line with 2012 (2, 319 kliters). Eni’s strategy in the rest of Europe aims at increasing its market share, particularly in Germany, Austria and in Eastern European Countries (in particular, in Czech Republic) leveraging on the synergies ensured by the proximity of these markets to Eni’s production and logistics facilities.